I. Introduction

II. What is a mutual fund?

III. Types of mutual funds

IV. How to choose a mutual fund

V. Best mutual funds to invest in

VI. Risks of investing in mutual funds

VII. How to invest in mutual funds

VIII. How to track your mutual fund investments

IX. How to manage your mutual fund investments

X. FAQ

| Feature | Description |

|---|---|

| Mutual funds | A type of investment that pools money from multiple investors and invests it in a variety of stocks, bonds, and other assets. |

| Investment | The act of putting money into something with the expectation of getting a return on your investment. |

| Stock market | A market where stocks are bought and sold. |

| Diversification | The practice of spreading your investments across different asset classes in order to reduce risk. |

| Risk-return tradeoff | The relationship between the risk and return of an investment. |

II. What is a mutual fund?

A mutual fund is a type of investment vehicle that pools money from investors and invests it in a diversified portfolio of stocks, bonds, and other assets. Mutual funds are offered by investment companies and are typically managed by professional fund managers.

Mutual funds offer a number of advantages over investing in individual stocks or bonds, including:

- Diversification: By investing in a mutual fund, you can spread your risk across a variety of different assets, which can help to reduce the volatility of your portfolio.

- Professional management: Mutual funds are managed by professional fund managers who have the expertise and experience to select investments that are likely to perform well over time.

- Convenience: Mutual funds can be purchased and sold through a variety of different channels, making them a convenient investment option for investors of all ages and experience levels.

However, mutual funds also have some disadvantages, including:

- Expenses: Mutual funds typically have higher fees than investing in individual stocks or bonds.

- Taxes: Mutual funds may be subject to capital gains taxes when they are sold.

- Liquidity: Mutual funds may not be as liquid as investing in individual stocks or bonds, which can make it difficult to sell your shares quickly if you need to.

Overall, mutual funds can be a good investment option for investors who are looking for a diversified, professionally managed investment that is relatively convenient and affordable. However, it is important to be aware of the potential risks and costs associated with mutual funds before you invest.

III. Types of mutual funds

Mutual funds can be classified into different types based on their investment objectives, asset classes, and management styles.

Investment objectives

- Growth funds: These funds aim to achieve capital appreciation by investing in stocks and other growth-oriented investments.

- Income funds: These funds aim to generate income by investing in bonds and other income-producing investments.

- Balanced funds: These funds seek to balance the objectives of growth and income by investing in a mix of stocks, bonds, and other investments.

Asset classes

- Stock funds: These funds invest in stocks of companies of different sizes and industries.

- Bond funds: These funds invest in bonds issued by governments, corporations, and other entities.

- Money market funds: These funds invest in short-term debt instruments, such as Treasury bills and commercial paper.

Management styles

- Actively managed funds: These funds are managed by professional investment managers who actively trade the fund’s portfolio in an effort to outperform the market.

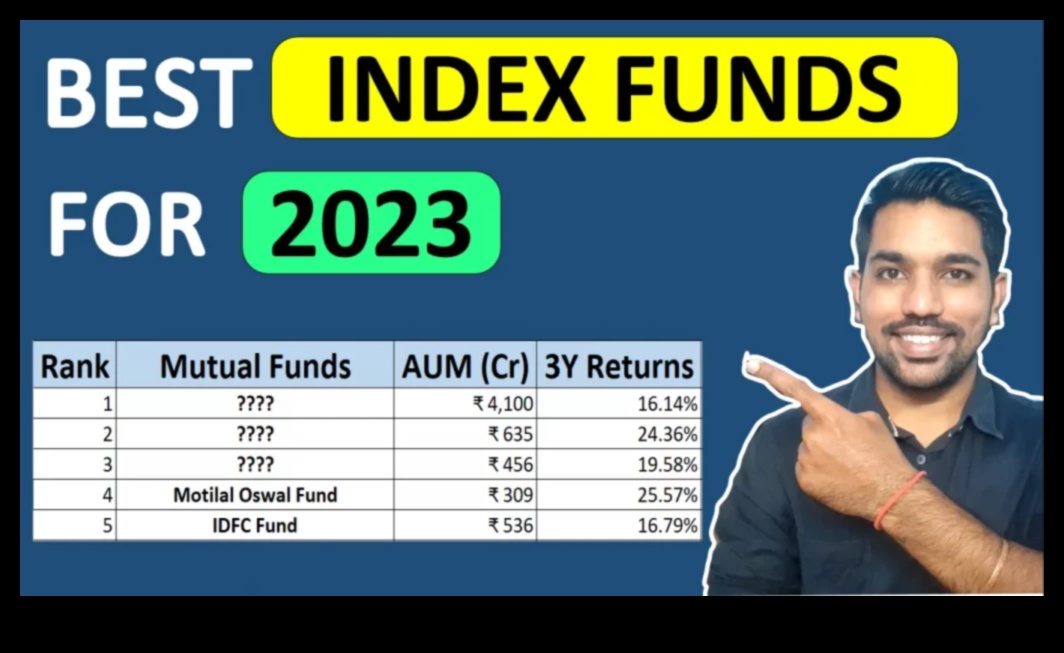

- Passively managed funds: These funds are managed by a computer algorithm that tracks a specific index, such as the S&P 500.

IV. How to choose a mutual fund

There are a number of factors to consider when choosing a mutual fund. These include:

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your investment budget

- Your tax situation

Once you have considered these factors, you can start to narrow down your choices. You can do this by looking at the following:

- The fund’s investment objective

- The fund’s performance history

- The fund’s fees

- The fund’s management team

It is important to remember that there is no one-size-fits-all approach to choosing a mutual fund. The best fund for you will depend on your individual circumstances.

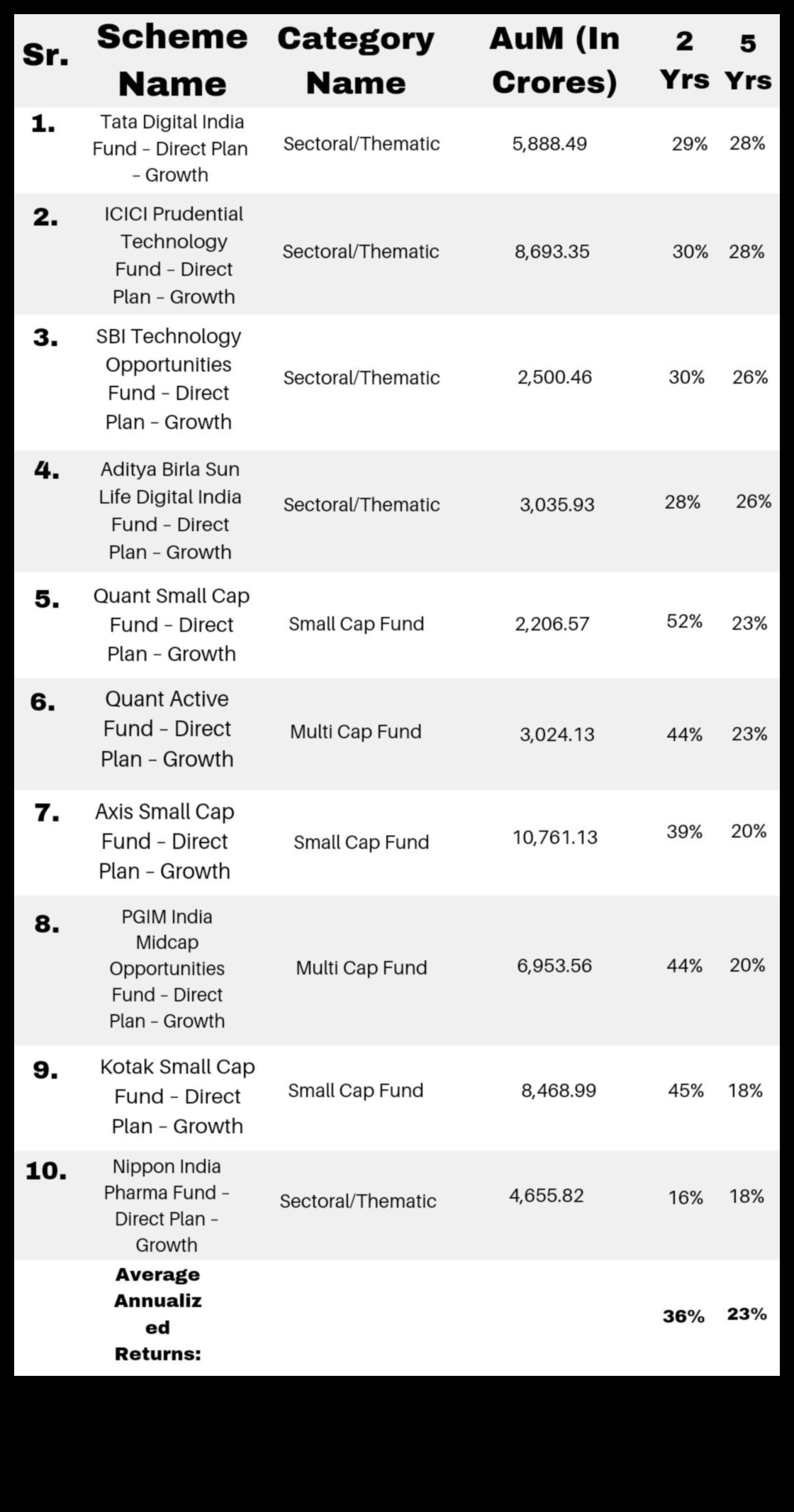

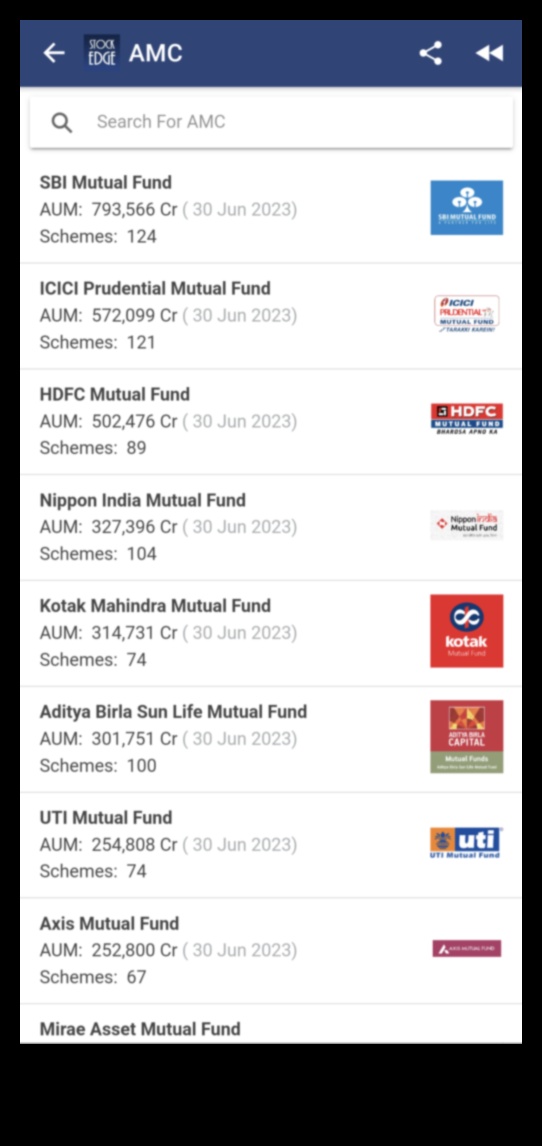

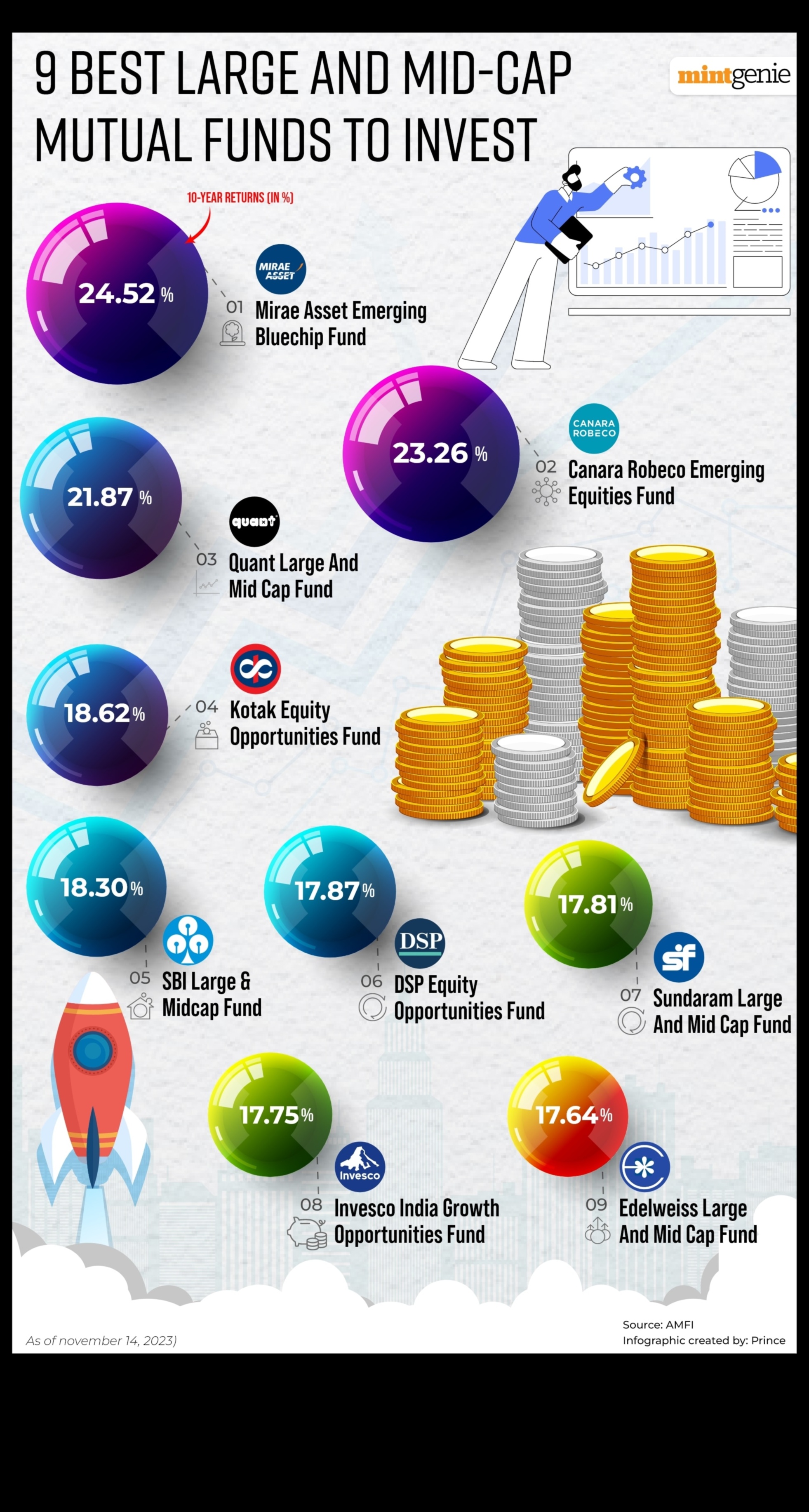

V. Best mutual funds to invest in

There is no one-size-fits-all answer to the question of what are the best mutual funds to invest in. The best mutual fund for you will depend on your individual financial goals, risk tolerance, and time horizon. However, there are a few factors that you can consider when making your decision, including:

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your investment experience

Once you have considered these factors, you can start to narrow down your options. There are a number of resources available to help you research mutual funds, such as online reviews, financial advisors, and investment newsletters.

Here are a few of the best mutual funds to consider, based on their performance over the past 10 years:

- Vanguard 500 Index Fund (VOO)

- iShares Core S&P 500 ETF (SPY)

- Charles Schwab S&P 500 Index Fund (SCHX)

- Fidelity 500 Index Fund (FXAIX)

- Vanguard Total Stock Market Index Fund (VTI)

These funds are all low-cost, diversified, and have a long track record of success. They are a good option for investors who are looking for a safe and reliable investment.

Of course, past performance is not always indicative of future results. It is important to remember that investing in mutual funds involves risk, and you could lose money. Before investing, you should always do your own research and make sure that you understand the risks involved.

VI. Risks of investing in mutual funds

There are a number of risks associated with investing in mutual funds, including:

- Market risk: The value of a mutual fund can go down as well as up, and there is no guarantee that you will get back your original investment.

- Manager risk: The performance of a mutual fund can depend heavily on the skill of the fund manager. If the manager leaves the fund or is replaced, the performance of the fund may suffer.

- Liquidity risk: Mutual funds are not as liquid as stocks or bonds, and it may take some time to sell your shares if you need to.

- Tax risk: Mutual funds are subject to taxes on their capital gains and dividends, and these taxes can reduce your return on investment.

It is important to be aware of these risks before investing in mutual funds. However, it is also important to remember that mutual funds can offer a number of benefits, such as diversification, professional management, and tax efficiency.

VII. How to invest in mutual fundsThere are a few different ways to invest in mutual funds. You can invest directly through a mutual fund company, through a broker, or through a retirement plan such as a 401(k) or IRA.

To invest directly through a mutual fund company, you will need to open an account with the company. You can then choose the mutual funds you want to invest in and make a deposit.

To invest through a broker, you will need to open an account with a brokerage firm. You can then choose the mutual funds you want to invest in and make a deposit. Your broker will then place the order to purchase the mutual funds for you.

To invest through a retirement plan, you will need to contribute money to your plan through your employer. Your employer will then invest the money in mutual funds on your behalf.

Once you have invested in a mutual fund, you will need to keep track of your investment. You can do this by checking the value of your investment regularly and by reading the fund’s prospectus.

If you want to sell your mutual fund shares, you can do so through your mutual fund company, your broker, or your retirement plan. You will need to pay a sales charge when you sell your shares.

How to track your mutual fund investments

Tracking your mutual fund investments is important to ensure that you are making progress towards your financial goals. There are a few different ways to track your mutual fund investments, including:

-

Using the mutual fund’s website or mobile app. Most mutual funds have a website or mobile app that allows you to view your account balance, track your investments, and make changes to your account.

-

Using a third-party investment tracking tool. There are a number of third-party investment tracking tools available that allow you to track your investments from multiple accounts in one place.

-

Talking to your financial advisor. Your financial advisor can help you track your investments and make sure that you are on track to reach your financial goals.

It is important to track your mutual fund investments regularly so that you can make sure that you are making progress towards your financial goals. By tracking your investments, you can also identify any potential problems early on and take steps to correct them.

How to manage your mutual fund investments

Once you have invested in a mutual fund, there are a few things you can do to manage your investments.

- Keep track of your investments.

- Rebalance your portfolio as needed.

- Review your investment goals and risk tolerance regularly.

- Consider selling your investments if your goals have changed.

Here is a more detailed explanation of each of these steps.

Keep track of your investments

The first step in managing your mutual fund investments is to keep track of your investments. This means knowing how much money you have invested in each fund, how the funds have performed over time, and what your overall portfolio is worth.

There are a few different ways to keep track of your investments. You can use a mutual fund website or app, a financial advisor, or a budgeting tool.

Rebalance your portfolio as needed

As your financial situation changes, you may need to rebalance your portfolio. This means adjusting the allocation of your investments so that they are still in line with your goals and risk tolerance.

For example, if you have saved up for a down payment on a house, you may want to reduce the amount of money you have invested in stocks and increase the amount you have invested in bonds.

Review your investment goals and risk tolerance regularly

It is important to review your investment goals and risk tolerance regularly. This will help you make sure that your investments are still aligned with your long-term goals.

For example, if you are planning to retire in 10 years, you will need to invest in more aggressive investments than if you are planning to retire in 20 years.

Consider selling your investments if your goals have changed

If your financial situation or goals change, you may need to sell some of your investments. For example, if you lose your job, you may need to sell some of your stocks to cover your living expenses.

Selling your investments can be a difficult decision, but it is important to remember that it is sometimes necessary to make changes in order to achieve your financial goals.

X. FAQ

Q: What is a mutual fund?

A: A mutual fund is a type of investment vehicle that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are typically managed by professional investment managers who are responsible for selecting the investments that make up the fund’s portfolio.

Q: What are the different types of mutual funds?

A: There are many different types of mutual funds, each with its own unique investment objectives and strategies. Some of the most common types of mutual funds include:

- Stock funds

- Bond funds

- Index funds

- Target-date funds

- Exchange-traded funds (ETFs)

Q: How do I choose a mutual fund?

A: There are a few factors to consider when choosing a mutual fund, including your investment goals, risk tolerance, and time horizon. You should also consider the fees associated with the fund and its historical performance.

Here are some tips for choosing a mutual fund:

- Set your investment goals.

- Determine your risk tolerance.

- Consider your time horizon.

- Research the fees associated with the fund.

- Review the fund’s historical performance.