How Do Hedge Funds Work?

Hedge funds are private investment funds that pool money from investors and use it to invest in a variety of financial instruments. They are typically structured as limited partnerships, with the general partner responsible for managing the fund and the limited partners providing the capital.

Hedge funds are often used by sophisticated investors who are looking for high returns and are willing to take on more risk than is typically available in traditional investments. Hedge funds can invest in a wide range of assets, including stocks, bonds, derivatives, and commodities. They can also use a variety of investment strategies, such as long-short investing, market neutral investing, and event-driven investing.

Hedge funds can be a good investment for investors who are looking for high returns and are willing to take on more risk. However, it is important to remember that hedge funds are not without risk. Investors should carefully consider their investment goals and risk tolerance before investing in a hedge fund.

Benefits of Investing in Hedge Funds

There are a number of benefits to investing in hedge funds, including:

- Potential for high returns

- Diversification

- Flexibility

- Professional management

Hedge funds can potentially generate higher returns than traditional investments, such as stocks and bonds. This is because hedge funds can use a variety of investment strategies that are designed to minimize risk and maximize returns.

Hedge funds can also provide diversification to a portfolio. By investing in a hedge fund, investors can reduce their exposure to the risks of individual stocks or bonds.

Hedge funds are typically more flexible than traditional investments. They can invest in a wider range of assets and use a wider range of investment strategies. This flexibility allows hedge funds to adapt to changing market conditions and generate returns in different market environments.

Hedge funds are typically managed by experienced and skilled professionals. These professionals have the knowledge and experience to identify and invest in opportunities that can generate high returns.

Risks of Investing in Hedge Funds

There are also a number of risks associated with investing in hedge funds, including:

- High risk

- Lack of liquidity

- Costs

- Fraud

Hedge funds are typically riskier than traditional investments. This is because hedge funds use a variety of investment strategies that can involve a high degree of risk.

Hedge funds can be illiquid, meaning that it can be difficult to sell your investment in a hedge fund. This can be a problem if you need to access your money quickly.

Hedge funds can be expensive. They typically charge high fees, which can eat into your returns.

Hedge funds are not regulated as closely as traditional investments. This can make them more vulnerable to fraud.

How to Choose a Hedge Fund

There are a number of factors to consider when choosing a hedge fund, including:

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your investment budget

You should also consider the following factors when choosing a hedge fund:

- The fund’s track record

- The fund’s fees

- The fund’s investment strategy

- The fund’s management team

Once you have considered all of these factors, you can start to narrow down your choices. You should then contact the hedge fund manager and ask them any questions you have.

How to Invest in a Hedge Fund

Investing in a hedge fund is not as simple as investing in a stock or bond. There are a number of steps involved, including:

- Opening an account with a hedge fund manager

- Providing the manager with your investment goals and risk

Feature Hedge Fund Investment Hedge funds can invest in a wide variety of assets, including stocks, bonds, commodities, and derivatives. Risk Management Hedge funds use a variety of risk management techniques to protect their portfolios from losses. Return Hedge funds have historically generated higher returns than traditional investments, but they also carry higher risks. Trading Hedge funds use a variety of trading strategies to generate returns.

What is a hedge fund?

A hedge fund is a type of investment fund that uses a variety of strategies to generate returns for its investors. Hedge funds typically invest in a wide range of assets, including stocks, bonds, commodities, and derivatives. They may also use leverage and short selling to magnify their returns.

Hedge funds are typically structured as private funds, which means that they are only available to accredited investors. This is because hedge funds are often considered to be high-risk investments, and the Securities and Exchange Commission (SEC) requires that accredited investors have a minimum net worth of $1 million or have earned at least $200,000 in each of the last two years.

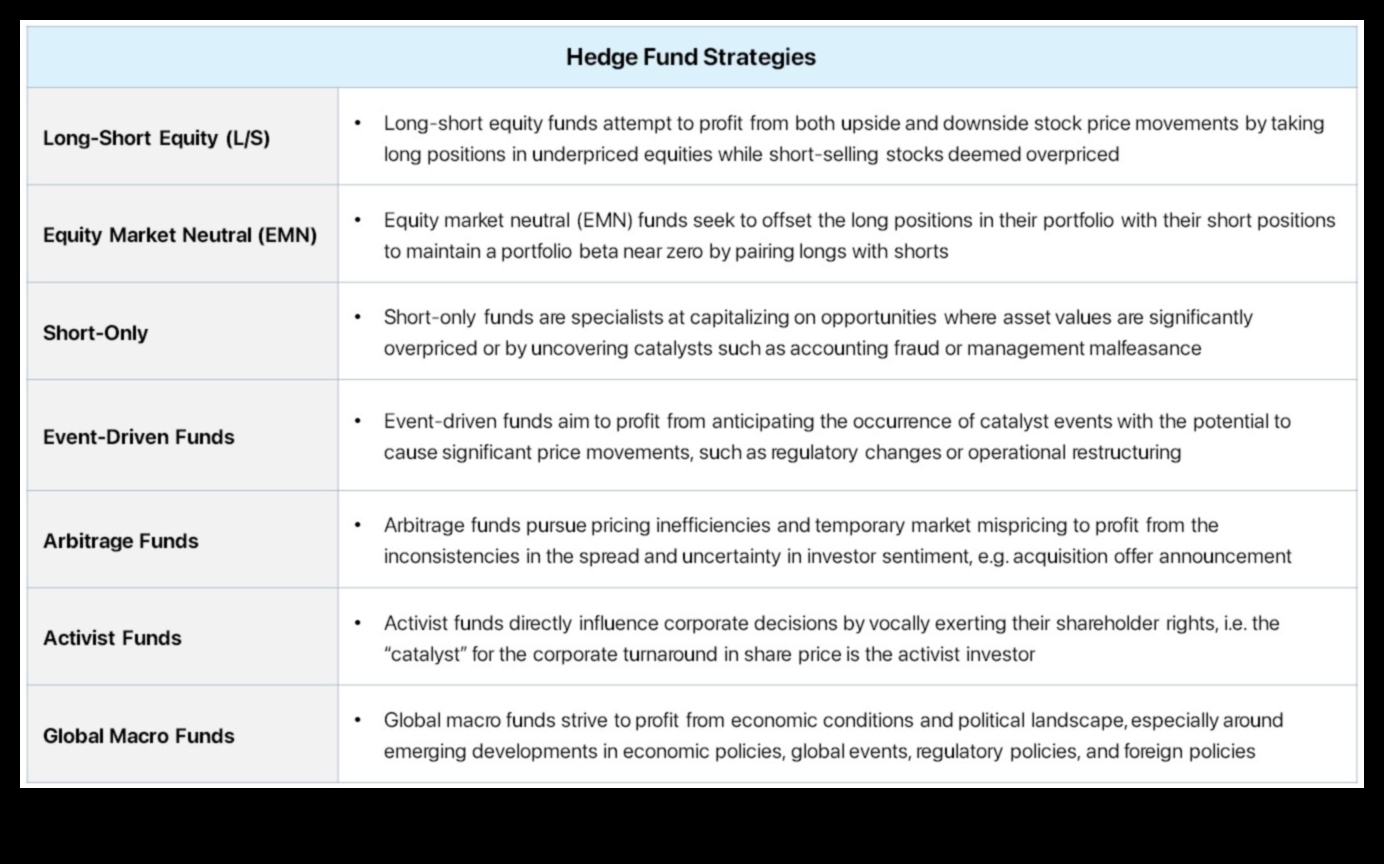

III. Types of hedge funds

There are many different types of hedge funds, each with its own unique investment strategy. Some of the most common types of hedge funds include:

- Equity hedge funds invest in stocks and other equity securities.

- Fixed income hedge funds invest in bonds and other fixed income securities.

- Macro hedge funds invest in a variety of assets, including stocks, bonds, currencies, and commodities.

- Event-driven hedge funds invest in companies that are undergoing significant changes, such as mergers, acquisitions, or bankruptcies.

- CTAs (commodity trading advisors) trade in commodities futures and options.

- Funds of funds invest in other hedge funds.

Each type of hedge fund has its own unique risk and return profile. Investors should carefully consider their investment objectives and risk tolerance before investing in a hedge fund.

IV. How do hedge funds work?

Hedge funds are a type of investment fund that uses a variety of strategies to generate returns. These strategies can include long and short positions in stocks, bonds, commodities, and other financial instruments. Hedge funds also often use derivatives, such as options and futures, to magnify their returns or to hedge against risk.

The goal of hedge funds is to generate returns that are higher than the returns of the overall market. However, hedge funds also aim to minimize risk, so they typically do not invest in illiquid or risky assets.

Hedge funds are typically structured as private funds, which means that they are not available to the general public. This is because hedge funds often use complex strategies that require a high level of expertise to understand.

Hedge funds are also subject to less regulation than other types of investment funds. This means that they have more freedom to invest in a wider range of assets and to use more complex strategies.

Hedge funds can be a good investment for investors who are looking for high returns and who are willing to take on some risk. However, it is important to remember that hedge funds are not without risk, and investors should carefully consider their investment objectives and risk tolerance before investing in a hedge fund.

V. Benefits of investing in hedge funds

There are a number of benefits to investing in hedge funds, including:

- Hedge funds can provide diversification to a portfolio.

- Hedge funds can help to reduce risk.

- Hedge funds can generate higher returns than traditional investments.

- Hedge funds can provide access to alternative investments.

- Hedge funds can offer a high degree of customization.

However, it is important to note that hedge funds are also associated with a number of risks, including:

- Hedge funds are often illiquid.

- Hedge funds can be expensive to invest in.

- Hedge funds can be complex and difficult to understand.

- Hedge funds are not regulated in the same way as traditional investments.

Investors should carefully consider the benefits and risks of investing in hedge funds before making a decision.

VI. Risks of investing in hedge funds

There are a number of risks associated with investing in hedge funds, including:

High fees: Hedge funds typically charge high fees, which can eat into your returns.

Illiquidity: Hedge funds can be illiquid, meaning that it can be difficult to sell your investment quickly if you need to.

Volatility: Hedge funds can be volatile, and your investment value can fluctuate significantly over time.

Risk of fraud: Hedge funds are not regulated by the Securities and Exchange Commission (SEC), and there is a risk of fraud.

Complexity: Hedge funds can be complex, and it can be difficult for investors to understand how they work.Before investing in a hedge fund, it is important to understand the risks involved. You should also do your research to find a reputable hedge fund that has a track record of success.

VII. How to choose a hedge fund

There are a number of factors to consider when choosing a hedge fund. These include:

- The fund’s investment strategy

- The fund’s track record

- The fund’s fees

- The fund’s liquidity

- The fund’s regulatory status

It is important to do your research and understand the risks and rewards of investing in a hedge fund before making a decision. You should also speak to a financial advisor to get personalized advice.

Here are some additional resources that you may find helpful:

How to invest in a hedge fund

There are a few different ways to invest in a hedge fund. The most common way is to invest through a fund of funds, which is a type of investment vehicle that invests in a variety of hedge funds. Another way to invest in a hedge fund is to directly invest in a single hedge fund. This option is generally only available to accredited investors, who have a net worth of at least $1 million or an annual income of at least $200,000.

The process of investing in a hedge fund can vary depending on the type of fund and the investment vehicle you use. However, the following steps are generally involved:

- Identify a hedge fund that you are interested in investing in.

- Contact the hedge fund and request a prospectus. The prospectus will provide you with information about the fund’s investment strategy, fees, and performance history.

- If you are satisfied with the information in the prospectus, you can submit an investment application.

- Once your application is approved, you will be required to make an initial investment. The size of the initial investment will vary depending on the fund.

- You will then be able to start receiving distributions from the fund. The frequency and amount of distributions will vary depending on the fund.

Investing in a hedge fund can be a good way to diversify your portfolio and generate high returns. However, it is important to remember that hedge funds are not without risk. Before investing in a hedge fund, you should carefully consider your investment objectives and risk tolerance.

IX. ConclusionHedge funds can be a complex and risky investment, but they can also offer the potential for high returns. If you are considering investing in a hedge fund, it is important to do your research and understand the risks involved.

Here are some tips for researching hedge funds:

- Read the fund’s prospectus carefully. This document will provide you with information about the fund’s investment strategy, fees, and risks.

- Talk to the fund’s manager. This is a good opportunity to ask questions about the fund’s strategy and to get a sense of the manager’s experience and qualifications.

- Check the fund’s performance history. This will give you an idea of how the fund has performed over time.

- Consider the fund’s fees. Hedge funds typically charge high fees, so it is important to make sure that the fees are justified by the fund’s performance.

If you are still unsure about whether or not to invest in a hedge fund, it is a good idea to consult with a financial advisor.

X. FAQ

Q: What is a hedge fund?

A: A hedge fund is a type of investment fund that uses a variety of strategies to generate returns for its investors. Hedge funds typically invest in a wide range of assets, including stocks, bonds, derivatives, and commodities.Q: What are the benefits of investing in a hedge fund?

A: There are a number of potential benefits to investing in a hedge fund, including:Diversification: Hedge funds can help to diversify your portfolio by investing in a variety of assets that are not correlated with each other. This can help to reduce your overall risk.

Potential for high returns: Hedge funds can potentially generate higher returns than traditional investments, such as stocks and bonds. However, it is important to note that hedge funds are also more volatile than traditional investments.

Professional management: Hedge funds are typically managed by experienced professionals who have a proven track record of success. This can give you peace of mind knowing that your money is being invested by experts.Q: What are the risks of investing in a hedge fund?

A: There are a number of risks associated with investing in a hedge fund, including:High volatility: Hedge funds are typically more volatile than traditional investments. This means that your investment could lose value quickly.

Lack of liquidity: Hedge funds may not be as liquid as traditional investments. This means that you may not be able to sell your investment quickly if you need to.

Fraud: There have been a number of cases of fraud involving hedge funds. This is why it is important to do your research before investing in a hedge fund.