How to Invest in a Mutual Fund

Mutual funds are a popular investment option for investors of all experience levels. They offer a diversified portfolio of stocks, bonds, and other investments, which can help to reduce risk and volatility. Mutual funds also offer professional management, which can help investors to make informed investment decisions.

If you are considering investing in a mutual fund, there are a few things you need to know. First, you need to understand what a mutual fund is and how it works. Second, you need to decide what type of mutual fund is right for you. Third, you need to find a reputable mutual fund company to invest with.

In this article, we will discuss each of these topics in more detail. We will also provide you with tips on how to choose the right mutual fund for your investment goals.

What is a Mutual Fund?

A mutual fund is a type of investment fund that pools money from investors and invests it in a diversified portfolio of stocks, bonds, and other investments. Mutual funds are typically managed by a professional investment manager who is responsible for making investment decisions on behalf of the fund’s shareholders.

Mutual funds offer a number of advantages over other investment options, including:

- Diversification: Mutual funds invest in a variety of different securities, which can help to reduce risk and volatility.

- Professional management: Mutual funds are managed by professional investment managers who have the experience and expertise to make informed investment decisions.

- Convenience: Mutual funds can be purchased through a brokerage account or directly from the fund company.

However, mutual funds also have some disadvantages, including:

- Fees: Mutual funds charge fees for management and administration. These fees can eat into your returns.

- Taxes: Mutual funds are taxed as ordinary income, which can be more expensive than other investment options.

- Liquidity: Mutual funds may not be as liquid as other investment options, such as stocks or bonds.

How to Choose a Mutual Fund

There are a number of factors to consider when choosing a mutual fund. These factors include:

- Your investment goals: What are you saving for? How long do you have until you need the money?

- Your risk tolerance: How much risk are you willing to take on?

- Your investment time horizon: How long do you plan to hold the fund?

- Your financial situation: How much money do you have to invest?

Once you have considered these factors, you can start to narrow down your choices. You can do this by looking at the following information:

- The fund’s investment objective: What type of investments does the fund invest in?

- The fund’s risk level: How risky is the fund?

- The fund’s historical performance: How has the fund performed over time?

- The fund’s fees: How much does the fund charge in fees?

You can find this information in the fund’s prospectus, which is a legal document that provides detailed information about the fund.

How to Invest in a Mutual Fund

Once you have chosen a mutual fund, you can invest in it through a brokerage account or directly from the fund company.

To invest in a mutual fund through a brokerage account, you will need to open an account with a brokerage firm. Once you have opened an account, you can transfer money into your account and then use the money to purchase shares of the mutual fund.

To invest in a mutual fund directly from the fund company, you will need to contact the fund company and provide them with your personal information and investment goals. The fund company will then send you

| Feature | Answer |

|---|---|

| Mutual fund investing | Mutual funds are a type of investment that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, and other securities. |

| How to invest in mutual funds | You can invest in mutual funds through a brokerage account or through a financial advisor. |

| Types of mutual funds | There are many different types of mutual funds, each with its own unique risk and return profile. |

| Mutual fund risks | There are a number of risks associated with investing in mutual funds, including market risk, interest rate risk, and inflation risk. |

| Mutual fund returns | The returns on mutual funds can vary widely, depending on the type of fund and the market conditions. |

1. Introduction

Mutual funds are a type of investment vehicle that pool together money from multiple investors and invest it in a variety of stocks, bonds, and other securities. This diversification can help to reduce risk and volatility, and it can also make it easier for investors to access a wide range of investments that they might not be able to afford on their own.

Mutual funds are typically managed by professional investment managers, who use their expertise to select the investments that are included in the fund. This can be a valuable resource for investors who do not have the time or expertise to manage their own investments.

Mutual funds can be a good option for investors of all experience levels, and they can be a great way to build wealth over time. However, it is important to understand the risks and rewards of investing in mutual funds before you make a decision.

How do mutual funds work?

Mutual funds are a type of investment vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, and other securities. This diversification helps to reduce risk and can provide investors with a higher return on their investment than they would get if they invested in individual stocks or bonds.

Mutual funds are managed by professional investment managers who are responsible for selecting the investments that make up the fund’s portfolio. These managers are typically experienced in the financial markets and have a proven track record of success.

Mutual funds can be either open-ended or closed-ended. Open-ended funds allow investors to buy and sell shares at any time, while closed-ended funds trade on an exchange like stocks.

Mutual funds are a popular investment option for both individual investors and retirement plans. They offer a number of advantages over other investment options, including diversification, professional management, and liquidity.

4. Types of mutual funds

There are many different types of mutual funds, each with its own unique characteristics. Some of the most common types of mutual funds include:

- Stock funds: These funds invest in stocks, which are shares of ownership in a company. Stock funds can be either diversified, which means they invest in a variety of stocks from different industries, or focused, which means they invest in a specific industry or sector.

- Bond funds: These funds invest in bonds, which are loans made to governments or corporations. Bond funds can be either short-term, which means they invest in bonds that mature in less than one year, or long-term, which means they invest in bonds that mature in more than one year.

- Money market funds: These funds invest in short-term debt instruments, such as Treasury bills and commercial paper. Money market funds are considered to be low-risk investments, and they are often used as a place to park cash until it is needed for other purposes.

- Index funds: These funds track the performance of a specific index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds are a good option for investors who want to track the performance of the market without having to actively manage their investments.

- Target-date funds: These funds are designed to help investors reach a specific financial goal, such as retirement. Target-date funds gradually become more conservative over time as the investor approaches retirement age.

When choosing a mutual fund, it is important to consider your investment goals, risk tolerance, and time horizon. There are a variety of different mutual funds available, so you should be able to find one that meets your needs.

How to choose a mutual fund

When choosing a mutual fund, there are a few things you should consider, including:

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your budget

Once you have considered these factors, you can start to narrow down your choices. You can do this by looking at the different types of mutual funds available, as well as their performance history. You can also read reviews of mutual funds from financial experts and investors.

When you are ready to make a decision, it is important to remember that there is no one-size-fits-all approach to investing. The best mutual fund for you will depend on your individual circumstances.

Here are a few tips for choosing a mutual fund:

- Do your research. Read the prospectus and financial statements of any mutual fund you are considering. This will help you understand the fund’s investment objectives, strategies, and risks.

- Diversify your portfolio. Don’t put all of your eggs in one basket. By investing in a variety of mutual funds, you can reduce your risk and improve your chances of achieving your investment goals.

- Rebalance your portfolio regularly. As your financial situation changes, so will your investment goals. It is important to rebalance your portfolio regularly to ensure that it is still aligned with your goals.

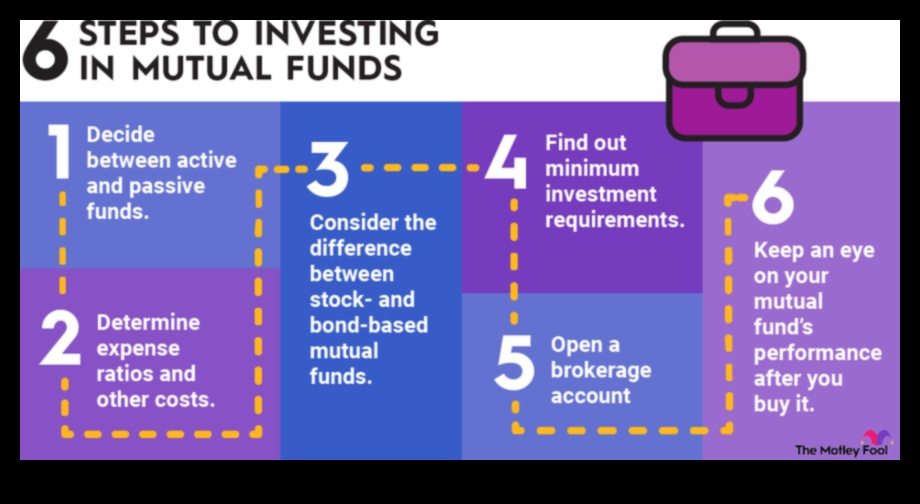

6. How to invest in mutual funds

There are a few different ways to invest in mutual funds. The most common way is to open a brokerage account and purchase shares of the mutual fund directly from the fund company. You can also invest in mutual funds through a financial advisor or through a robo-advisor.

To open a brokerage account, you will need to provide some personal information, such as your name, address, and Social Security number. You will also need to provide a deposit to fund your account. Once your account is open, you can purchase shares of any mutual fund that is available through the brokerage firm.

If you are not comfortable investing in mutual funds on your own, you can work with a financial advisor. A financial advisor can help you choose the right mutual funds for your investment goals and risk tolerance. They can also help you manage your investments and make sure that your portfolio is on track to meet your goals.

Robo-advisors are a relatively new way to invest in mutual funds. Robo-advisors use algorithms to help you choose the right mutual funds for your investment goals and risk tolerance. They can also help you manage your investments and make sure that your portfolio is on track to meet your goals.

No matter how you choose to invest in mutual funds, it is important to do your research and understand the risks involved before you make any investment decisions.

7. Mutual fund risksMutual funds offer a number of risks, including:

- Market risk: The value of a mutual fund can go down as well as up. This is because the value of the underlying investments in the fund can go down as well as up.

- Interest rate risk: When interest rates rise, the value of bonds in a mutual fund can go down. This is because bonds with lower interest rates become less attractive to investors.

- Credit risk: The value of a mutual fund can go down if the companies in which it invests default on their debt.

- Liquidity risk: Mutual funds may not be able to sell their investments quickly enough to meet redemption requests from investors. This can lead to a decline in the value of the fund.

- Management risk: The performance of a mutual fund can depend on the skill of the fund manager. If the fund manager leaves the fund, the performance of the fund may suffer.

It is important to be aware of these risks before investing in a mutual fund.

Mutual fund risks

Mutual funds offer a number of risks, including:

- Market risk: The value of a mutual fund can go up or down, depending on the performance of the underlying investments.

- Interest rate risk: When interest rates rise, the value of bonds in a mutual fund can decline.

- Credit risk: If a company or government defaults on its debt, the value of a mutual fund that invests in that company or government’s bonds can decline.

- Liquidity risk: Some mutual funds may not be able to sell their investments quickly, which can make it difficult to withdraw money from the fund when you need it.

- Management risk: The performance of a mutual fund can depend on the skill of the fund manager.

It is important to be aware of these risks before investing in a mutual fund. You should also diversification your portfolio to minimize your risk.

9. Tax implications of mutual fundsWhen you invest in a mutual fund, you may have to pay taxes on your investment gains. The type of taxes you pay will depend on the type of mutual fund you invest in and your tax status.

There are two main types of mutual funds: taxable and tax-exempt. Taxable mutual funds are taxed as ordinary income, which means that you pay taxes on your investment gains each year. Tax-exempt mutual funds are not taxed at the federal level, but you may have to pay state and local taxes on your investment gains.

The tax implications of mutual funds can be complex, so it is important to consult with a tax advisor before investing.

10. FAQ

Here are some of the most common questions about mutual funds:

-

What is a mutual fund?

-

How do mutual funds work?

-

How do I choose a mutual fund?

Here are the answers to these questions:

-

A mutual fund is a type of investment that pools money from investors and invests it in a variety of stocks, bonds, and other securities.

-

Mutual funds work by providing investors with a diversified portfolio of investments that they can access through a single investment. This can be a more cost-effective and convenient way to invest than buying individual stocks or bonds.

-

There are a number of factors to consider when choosing a mutual fund, including your investment goals, risk tolerance, and time horizon.

For more information on mutual funds, please visit the following resources: