What can 529 funds be used for?

529 plans are tax-advantaged savings plans that can be used to pay for qualified education expenses, such as tuition, fees, books, and supplies. Qualified education expenses also include room and board, as well as expenses for computers and other technology.

529 plans can be used to pay for college, trade school, or other types of post-secondary education. They can also be used to pay for apprenticeships or other vocational training programs.

There are two main types of 529 plans:

- Prepaid tuition plans allow you to purchase a certain amount of tuition at a specific college or university. The price of the tuition is locked in, so you don’t have to worry about rising costs.

- College savings plans allow you to invest your money in a variety of different investment options. The earnings on your investments grow tax-deferred, and you can withdraw the money tax-free as long as it’s used for qualified education expenses.

529 plans are a great way to save for college or other post-secondary education. They offer a number of tax benefits, and they can help you save money on your child’s education.

| Feature | 529 plans | College savings | Education savings | Tax-advantaged savings | Qualified education expenses |

|---|---|---|---|---|---|

| What is it? | A tax-advantaged savings plan designed to encourage saving for future education costs. | A way to save for college tuition, fees, books, and other expenses. | A way to save for any type of educational expense, including college, trade school, or technical training. | A way to reduce your taxes on your investment earnings. | Education costs that are eligible for tax-free withdrawals from a 529 plan include tuition, fees, books, and other expenses. |

| Who can use it? | Anyone can open a 529 plan, but the beneficiary must be a U.S. citizen or resident. | Anyone can save for college, regardless of their income. | Anyone can save for any type of educational expense, regardless of their income. | Anyone can use a 529 plan, regardless of their income. | Anyone can use a 529 plan to pay for qualified education expenses, regardless of their income. |

| How does it work? | Contributions to a 529 plan are made with after-tax dollars. The earnings on the investments in the plan grow tax-deferred. When withdrawals are made to pay for qualified education expenses, they are tax-free. | College savings plans are typically sponsored by a state or educational institution. Contributions are made with after-tax dollars, and the earnings on the investments grow tax-deferred. When withdrawals are made to pay for qualified education expenses, they are tax-free. | Education savings accounts are sponsored by a financial institution. Contributions are made with after-tax dollars, and the earnings on the investments grow tax-deferred. When withdrawals are made to pay for qualified education expenses, they are tax-free. | Tax-advantaged savings accounts are offered by a variety of financial institutions. Contributions are made with after-tax dollars, and the earnings on the investments grow tax-deferred. When withdrawals are made, they are taxed as ordinary income. | Qualified education expenses include tuition, fees, books, and other expenses that are required for enrollment or attendance at an eligible educational institution. |

| What are the benefits? | Tax-deferred growth on investments. | Tax-free withdrawals for qualified education expenses. | Flexibility in how the funds can be used. | No income limits on who can contribute. | No age limits on who can benefit from the plan. |

| What are the drawbacks? | There are limits on the amount that can be contributed each year. | There are penalties for withdrawing funds for non-qualified expenses. | The funds must be used for education expenses within a certain time frame. | The earnings on the investments are taxed as ordinary income when they are withdrawn. | The funds can only be used for qualified education expenses. |

What can 529 funds be used for?

529 plans can be used to pay for qualified education expenses, which include tuition, fees, books, supplies, and other costs associated with attending college or other post-secondary education.

Qualified education expenses also include room and board, as well as expenses for computers and other technology, as long as they are used for educational purposes.

529 plans cannot be used to pay for personal expenses, such as living expenses or transportation costs.

For more information on qualified education expenses, please see the IRS website.

What can 529 funds be used for?

529 plans can be used to pay for qualified education expenses, which include:

- Tuition and fees

- Books and supplies

- Room and board

- Transportation

- Computers and other technology

- Other expenses related to the student’s education

It is important to note that 529 plans cannot be used to pay for non-qualified expenses, such as living expenses or personal expenses. If you withdraw funds from a 529 plan to pay for non-qualified expenses, you will have to pay income taxes on the earnings, as well as a 10% penalty.

For more information on the qualified education expenses that can be paid for with 529 plans, please refer to the IRS website.

What can 529 funds be used for?

529 plans can be used to pay for qualified education expenses, which include:

- Tuition and fees

- Books and supplies

- Room and board

- Transportation

- Computers and software

- Other expenses directly related to the student’s education

Qualified education expenses do not include personal expenses such as living expenses, entertainment, or travel.

For more information on qualified education expenses, please see the IRS website.

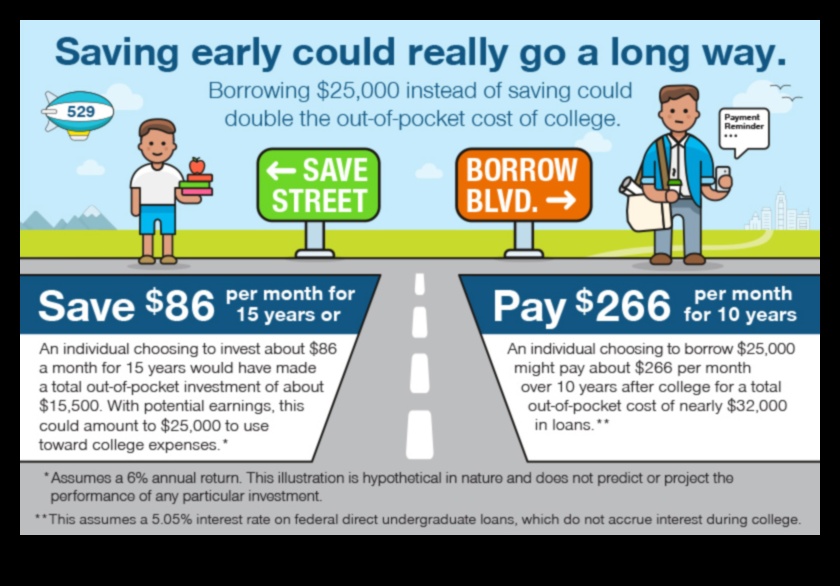

5. How much can I contribute to a 529 plan?The maximum amount that you can contribute to a 529 plan in a given year is $15,000 per beneficiary. However, there are some exceptions to this rule. For example, if you are married and filing jointly, you can contribute up to $30,000 per year. You can also contribute more than the annual limit if you make catch-up contributions. Catch-up contributions are allowed for individuals who are age 50 or older. The maximum catch-up contribution is $6,000 per year.

6. What can 529 funds be used for?

529 plans can be used to pay for qualified education expenses, which include:

- Tuition and fees at colleges, universities, and vocational schools

- Books, supplies, and equipment

- Room and board

- Transportation

- Student loan interest

- Other expenses that are necessary for the student to attend school

It is important to note that 529 plans cannot be used to pay for non-qualified expenses, such as living expenses or personal expenses. If you withdraw funds from a 529 plan to pay for a non-qualified expense, you will have to pay income taxes on the earnings, as well as a 10% penalty.

For more information on the qualified education expenses that can be paid with 529 plans, please visit the IRS website.

7. How do I choose a 529 plan?

There are a few factors to consider when choosing a 529 plan.

- State tax benefits. Some states offer state tax deductions or credits for contributions to 529 plans that are sponsored by that state. If you live in a state that offers these benefits, it may be worth considering a 529 plan from that state.

- Investment options. The investment options available in a 529 plan can vary from one plan to another. It’s important to choose a plan that offers a variety of investment options so that you can choose the ones that are right for your goals and risk tolerance.

- Fees. Be sure to compare the fees charged by different 529 plans before you make a decision. Some plans have higher fees than others, and these fees can eat into your investment returns.

- Convenience. Consider how easy it will be for you to contribute to and manage your 529 plan. Some plans offer online account access and mobile apps, while others require you to mail in contributions or make phone calls.

Once you’ve considered these factors, you can start narrowing down your choices of 529 plans. You can find a list of 529 plans that are available in your state on the SavingforCollege.com website.

What are the different types of 529 plans?

There are two main types of 529 plans:

- Prepaid tuition plans

- Savings plans

Prepaid tuition plans allow you to lock in today’s tuition rates at a participating college or university. This can be a great option if you know where your child will be attending college and you are confident that the cost of tuition will not increase significantly. However, prepaid tuition plans can be inflexible and you may not be able to get your money back if your child does not end up attending college.

Savings plans allow you to invest your money in a variety of investment options, such as stocks, bonds, and mutual funds. This can be a more flexible option than prepaid tuition plans, as you can change the investment options as your financial situation changes. However, savings plans do not guarantee that your money will grow enough to cover the cost of college.

Ultimately, the best type of 529 plan for you will depend on your individual needs and circumstances. If you have any questions, you should consult with a financial advisor.

How do I open a 529 plan?

Opening a 529 plan is easy. You can do it online, through the mail, or by calling a financial advisor. Here are the steps involved:

- Choose a 529 plan provider. There are many different 529 plans available, so it’s important to do your research and choose one that’s right for you. You can compare 529 plans based on factors such as fees, investment options, and withdrawal rules.

- Open an account. Once you’ve chosen a 529 plan provider, you can open an account online, through the mail, or by calling a financial advisor. You’ll need to provide some basic information, such as your name, address, and Social Security number.

- Make a contribution. You can contribute to your 529 plan as often as you like, and the amount you contribute is up to you. However, there are annual contribution limits, which vary depending on the state you live in.

- Invest your money. The money in your 529 plan will be invested in a variety of investments, such as stocks, bonds, and mutual funds. You can choose how your money is invested, or you can let the plan’s investment manager choose for you.

- Withdraw funds. You can withdraw funds from your 529 plan to pay for qualified education expenses, such as tuition, fees, books, and supplies. There are no federal taxes on withdrawals for qualified education expenses, and some states also offer state tax breaks.

For more information on how to open a 529 plan, please visit the Saving for College website.

10. FAQ

Question 1: What is a 529 plan?

Answer 1: A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs.

Question 2: How do 529 plans work?

Answer 2: 529 plans allow you to invest money in a variety of investment options, such as stocks, bonds, and mutual funds. The earnings on your investments grow tax-free, and you can withdraw the money tax-free as long as it is used for qualified education expenses.

Question 3: What are the benefits of a 529 plan?

Answer 3: The benefits of a 529 plan include:

- Tax-free growth on earnings

- Tax-free withdrawals for qualified education expenses

- Flexibility in terms of investments and withdrawal options

- Simplicity of administration