How to Invest in an Index Fund

Index funds are a type of mutual fund that tracks a specific index, such as the S&P 500 or the Dow Jones Industrial Average. By investing in an index fund, you are essentially investing in a diversified portfolio of stocks that mirrors the performance of the underlying index.

Index funds are a popular investment choice for a variety of reasons. They are relatively inexpensive, they are diversified, and they have historically outperformed actively managed funds.

If you are looking for a simple and low-cost way to invest in the stock market, an index fund may be a good option for you.

How to Choose an Index Fund

There are a few things to consider when choosing an index fund.

- The type of index you want to track. There are many different indexes to choose from, each with its own unique characteristics. Some of the most popular indexes include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

- The expense ratio. The expense ratio is the fee that you pay to the fund manager. It is expressed as a percentage of your investment and is deducted from your returns on a regular basis.

- The minimum investment. The minimum investment is the amount of money that you need to invest in order to open an account.

- The liquidity. The liquidity of a fund refers to how easily you can sell your shares. Some funds are more liquid than others.

Once you have considered these factors, you can start to narrow down your choices. There are many different index funds available, so you should be able to find one that meets your needs.

How to Invest in an Index Fund

Investing in an index fund is relatively simple. You can do so through a brokerage account. Once you have opened an account, you can simply select the index fund that you want to invest in and make a purchase.

The amount of money that you invest in an index fund is up to you. However, it is generally recommended that you invest for at least five years in order to give your investment time to grow.

Benefits of Investing in Index Funds

There are many benefits to investing in index funds. Some of the most notable benefits include:

- Diversification. Index funds are diversified by design, which means that you are not exposed to the risk of any single stock or company.

- Low cost. Index funds are typically very low-cost, which means that you can keep more of your money invested.

- Historical performance. Index funds have historically outperformed actively managed funds over the long term.

Risks of Investing in Index Funds

There are some risks associated with investing in index funds. Some of the most notable risks include:

- Market risk. The value of index funds can go down as well as up. This is because index funds are invested in the stock market, which is volatile.

- Currency risk. If you invest in an index fund that is denominated in a foreign currency, you are exposed to the risk of currency fluctuations.

- Liquidity risk. Some index funds may be less liquid than others. This means that it may be difficult to sell your shares quickly if you need to.

Tax Implications of Investing in Index Funds

The tax implications of investing in index funds can vary depending on the type of fund and your individual tax situation. It is important to consult with a tax advisor to understand the tax implications of investing in index funds.

How to Track Your Index Fund Investments

You

| Topic | Answer |

|---|---|

| Index fund | A type of mutual fund that tracks a particular market index, such as the S&P 500 or the Nasdaq 100. |

| Investing | The act of putting money into an asset with the expectation of generating a return. |

| Retirement | The period of time after a person has stopped working and is living on savings. |

| Stock market | A place where stocks are bought and sold. |

| Diversification | The practice of spreading your investments across different asset classes in order to reduce risk. |

II. What are index funds?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks a particular market index. This means that the fund’s performance is closely correlated to the performance of the index it tracks. For example, an S&P 500 index fund will track the performance of the S&P 500 stock index.

Index funds are a popular investment choice for investors of all experience levels. They are relatively low-cost, diversified, and can be used to achieve a variety of investment goals.

Here are some of the benefits of investing in index funds:

- Low cost

- Diversification

- Passive management

- Tax efficiency

Index funds are a great way to get started with investing or to add diversification to your existing portfolio. If you are looking for a low-cost, hands-off way to invest, an index fund may be a good option for you.

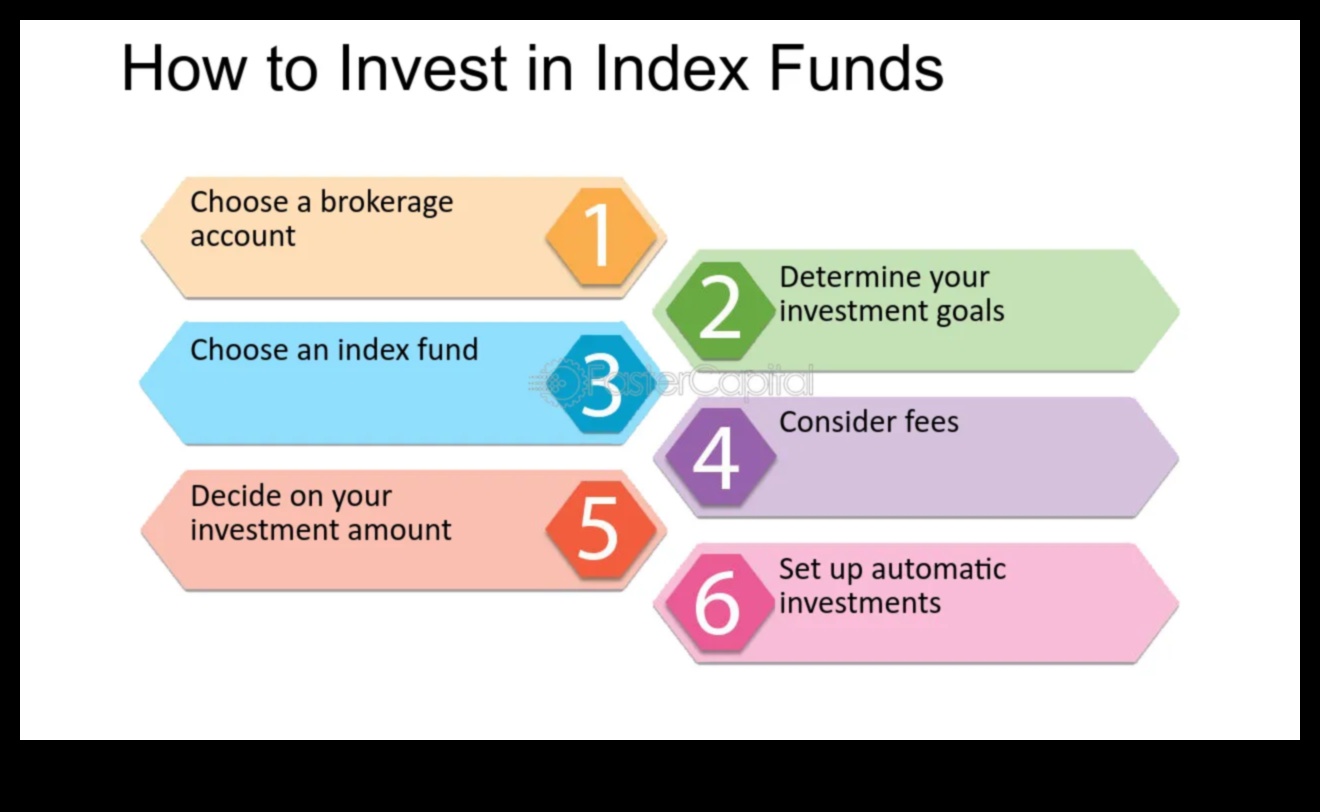

How to choose an index fund

When choosing an index fund, there are a few factors you should consider, including:

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your budget

Once you have considered these factors, you can start to narrow down your choices. There are a number of different index funds available, so it is important to do your research and find one that is right for you.

Some of the things you should look for when choosing an index fund include:

- The expense ratio

- The historical performance

- The diversification

- The liquidity

By considering these factors, you can make an informed decision about which index fund is right for you.

Here are a few tips for choosing an index fund:

- Start by talking to your financial advisor. They can help you understand your investment goals and risk tolerance and recommend a few funds that might be a good fit for you.

- Do your own research. Read articles, reviews, and other materials about index funds to learn more about how they work and what to look for when choosing one.

- Compare different funds. Look at the expense ratio, historical performance, diversification, and liquidity of different funds before making a decision.

- Don’t be afraid to ask questions. If you have any questions about an index fund, don’t hesitate to contact the fund company or your financial advisor.

By following these tips, you can choose an index fund that is right for you and help you reach your investment goals.

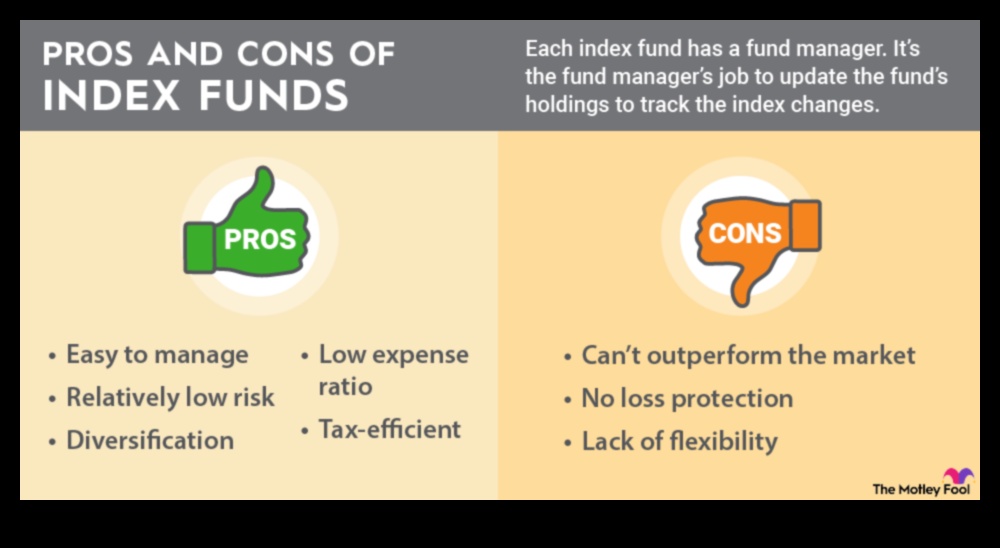

IV. Benefits of investing in index funds

Index funds offer a number of benefits over other investment options, including:

Diversification: Index funds invest in a wide range of stocks, which helps to reduce risk.

Low fees: Index funds typically have lower fees than actively managed funds.

Transparency: Index funds are transparent, which means you know exactly what you are invested in.

Passive management: Index funds are passively managed, which means there is no need to pay for an expensive investment manager.

Long-term performance: Index funds have historically outperformed actively managed funds over the long term.

V. Risks of investing in index funds

There are a few risks associated with investing in index funds, including:

- Market risk: The value of an index fund can go down as well as up, and there is no guarantee that you will make money.

- Liquidity risk: Index funds can be less liquid than individual stocks, meaning that it may be more difficult to sell your shares quickly if you need to.

- Tracking error: Index funds are designed to track a specific index, but there is always the possibility that they will not do so perfectly. This can lead to losses if the index performs better than the fund.

Despite these risks, index funds are still considered to be a relatively safe investment for long-term investors.

VI. How to choose an index fund

There are a few things to consider when choosing an index fund.

- The asset class

- The expense ratio

- The tracking error

- The liquidity

The asset class refers to the type of investments that the index fund tracks. For example, there are index funds that track stocks, bonds, commodities, and real estate.

The expense ratio is the annual fee that you pay to invest in an index fund. It is expressed as a percentage of your investment.

The tracking error is the difference between the return of the index fund and the return of the index that it tracks. A low tracking error means that the index fund is closely tracking the index.

The liquidity refers to how easy it is to buy and sell shares of the index fund.

Once you have considered these factors, you can start to narrow down your choices of index funds.

You can find a list of index funds on the websites of major investment companies. You can also use a financial advisor to help you choose an index fund.

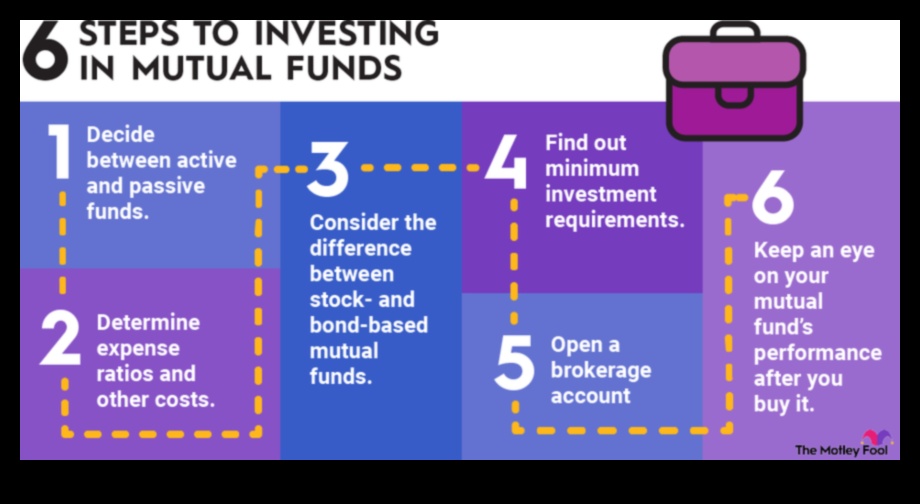

VII. How to invest in index funds

To invest in an index fund, you can either open an account with a brokerage firm or use a robo-advisor.

If you choose to open an account with a brokerage firm, you will need to provide some personal information, such as your name, address, and Social Security number. You will also need to fund your account with an initial investment. Once your account is funded, you can select the index fund you want to invest in.

If you choose to use a robo-advisor, you will need to provide some personal information, such as your age, income, and risk tolerance. The robo-advisor will then use this information to create a portfolio of index funds that is tailored to your individual needs.

Once you have selected an index fund, you can simply buy shares of the fund through your brokerage firm or robo-advisor.

Investing in index funds is a simple and easy way to diversify your portfolio and grow your wealth over time.

Tax implications of investing in index funds

When you invest in an index fund, you may have to pay taxes on your investment gains. The type of taxes you owe will depend on the type of index fund you invest in and your tax bracket.

For example, if you invest in a mutual fund that tracks the S&P 500, you will owe capital gains taxes on any gains you realize when you sell your shares. Capital gains taxes are taxed at a lower rate than ordinary income, so you may be able to save money on taxes by investing in index funds.

However, if you invest in an index fund that is held in a retirement account, such as a 401(k) or IRA, you will not have to pay any taxes on your investment gains until you withdraw them from the account. This can be a significant advantage for long-term investors, as it allows them to grow their wealth tax-free.

It is important to consult with a tax advisor to determine the best way to invest in index funds for your specific situation.

IX. How to track your index fund investments

Once you have invested in an index fund, it is important to track your investments so that you can see how they are performing. There are a few different ways to track your index fund investments.

One way to track your investments is to log in to your brokerage account and view your account history. This will show you the current value of your investments, as well as their historical performance.

Another way to track your investments is to use a financial tracking app or website. These tools can help you track your investments across multiple accounts, and they often provide charts and graphs that can help you visualize your investment performance.

Finally, you can also track your investments by reading the financial press. Newspapers, magazines, and websites often publish articles about index fund performance, and they can provide you with valuable insights into the markets.

By tracking your index fund investments, you can stay informed about your financial situation and make sure that your investments are on track to meet your goals.

X. FAQ

Q: What is an index fund?

A: An index fund is a mutual fund or exchange-traded fund (ETF) that tracks a particular market index. This means that the fund’s performance is closely linked to the performance of the index it tracks.

Q: How do index funds work?

A: Index funds work by investing in a large number of stocks that make up a particular index. This diversification helps to reduce risk, as the performance of one stock is not likely to have a significant impact on the overall performance of the fund.

Q: What are the benefits of investing in index funds?

A: There are many benefits to investing in index funds, including:

- Diversification: Index funds are diversified across a large number of stocks, which helps to reduce risk.

- Low fees: Index funds typically have lower fees than actively managed funds.

- Transparency: Index funds are transparent, meaning that investors know exactly what they are invested in.

- Convenience: Index funds are easy to invest in and trade.

Q: What are the risks of investing in index funds?

A: There are some risks associated with investing in index funds, including:

- Market risk: Index funds are subject to market risk, which means that their value can go down as well as up.

- Tracking error: Index funds may not track their underlying index perfectly, which can lead to losses.

- Liquidity risk: Index funds may not be as liquid as other investments, which means that it may be difficult to sell them quickly if needed.

Q: How to choose an index fund?

A: There are a few things to consider when choosing an index fund, including:

- Your investment goals: What are you investing for? (e.g., retirement, a down payment on a house)

- Your risk tolerance: How much risk are you willing to take?

- Your time horizon: How long do you plan to hold the investment?

- Your budget: How much can you afford to invest?

Q: How to invest in index funds?

A: There are a few different ways to invest in index funds, including:

- Through a brokerage account: You can open a brokerage account with a broker like Vanguard, Fidelity, or Charles Schwab and invest in index funds directly.

- Through a 401(k) or IRA: If you have a 401(k) or IRA, you may be able to invest in index funds through your employer’s plan.

- Through a robo-advisor: A robo-advisor is a service that can help you invest in index funds automatically.

Q: Tax implications of investing in index funds?

A: There are a few tax implications to consider when investing in index funds, including:

- Capital gains taxes: When you sell an index fund that has appreciated in value, you will owe capital gains taxes on the profit.

- Dividends: Index funds that pay dividends may be subject to dividend taxes.

- Qualified dividends: Qualified dividends are taxed at a lower rate than ordinary income.

Q: How to track your index fund investments?

A: There are a few ways to track your index fund investments, including:

- Your brokerage account: Your brokerage account will provide you with a statement that shows your investment balance and performance.

- A financial website: A financial website like Yahoo Finance or Google Finance can provide you with real-time quotes for your index funds.

- A mobile app: A mobile app like Robinhood or Vanguard Mobile can help you track your index fund investments on the go.