Emergency Fund

-

Emergency Fund Meaning

-

Why You Need an Emergency Fund

-

How Much Should You Have in an Emergency Fund

-

Where to Keep Your Emergency Fund

-

How to Save for an Emergency Fund

-

Using Your Emergency Fund

-

Rebuilding Your Emergency Fund

-

Emergency Fund Mistakes to Avoid

-

Emergency Fund Myths

-

FAQ

| Feature | Emergency Fund | Savings | Rainy Day Fund | Financial Cushion | Unexpected Expenses |

|---|---|---|---|---|---|

| Definition | A reserve of cash set aside to cover unexpected expenses | Money saved for future use | Funds set aside for unexpected events | A buffer against financial shocks | Expenses that are not part of your regular budget |

| Purpose | To cover unexpected expenses, such as job loss, medical bills, or car repairs | To provide for future needs, such as retirement or a down payment on a house | To protect against unexpected events, such as job loss or medical bills | To give you peace of mind and financial security | To avoid debt and financial hardship |

| Amount | 3-6 months of living expenses | Varies depending on your goals and financial situation | 3-6 months of living expenses | 6-12 months of living expenses | Depends on the unexpected expense |

| Accessibility | Easy to access, such as a savings account or money market fund | May be more difficult to access, such as a 401(k) or IRA | Easy to access | Easy to access | May be difficult to access, such as a credit card |

| Return | Low or no return | May earn a higher return than an emergency fund | Low or no return | Low or no return | May earn a higher return than an emergency fund |

II. Why You Need an Emergency Fund

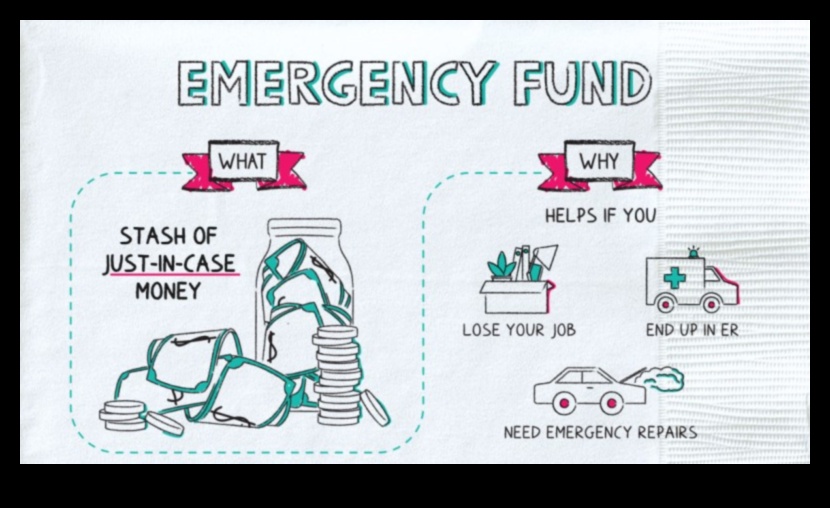

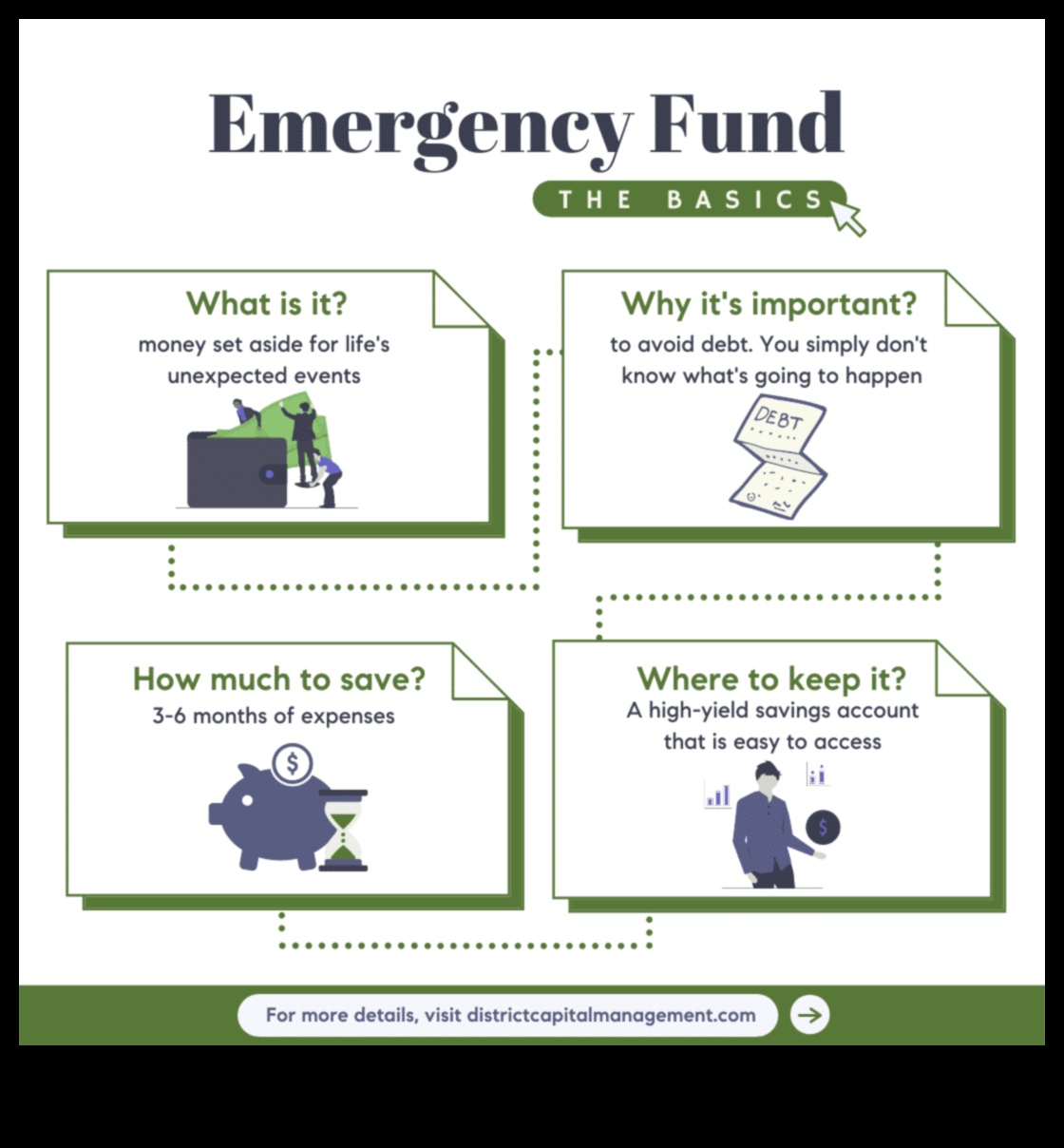

An emergency fund is a savings account that you set aside to cover unexpected expenses. These expenses can be anything from a car repair to a medical bill, and they can happen at any time. Having an emergency fund can help you to avoid debt and stress, and it can give you peace of mind knowing that you’re prepared for anything.

There are a few different reasons why you need an emergency fund. First, unexpected expenses can happen at any time. You may lose your job, have a medical emergency, or your car may break down. If you don’t have an emergency fund, you may have to put these expenses on credit cards or loans, which can lead to debt and financial hardship.

Second, having an emergency fund can help you to avoid stress. When you’re faced with an unexpected expense, it can be stressful trying to figure out how to pay for it. If you have an emergency fund, you can simply use the money from your savings to cover the expense, and you can avoid the stress of having to come up with the money on short notice.

Third, having an emergency fund can give you peace of mind. Knowing that you have money saved up to cover unexpected expenses can help you to feel more secure and less stressed about your financial situation.

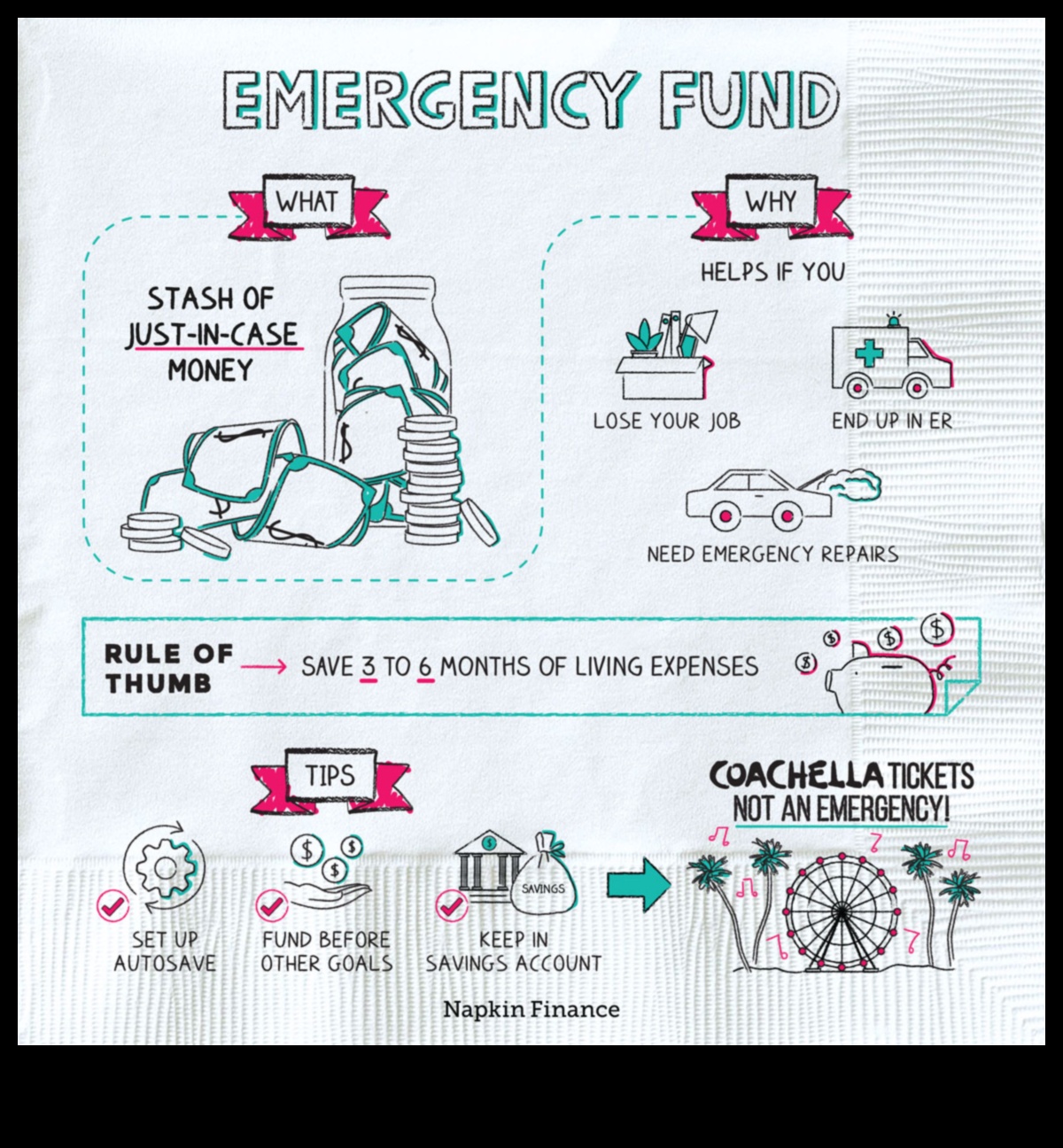

III. How Much Should You Have in an Emergency Fund

The amount of money you should have in your emergency fund depends on your individual circumstances. However, a good rule of thumb is to have enough money to cover 3-6 months of living expenses. This means that you would have enough money to pay for your rent or mortgage, food, utilities, and other essential expenses if you were to lose your job or experience another unexpected financial hardship.

If you have a high-paying job and few expenses, you may be able to get by with a smaller emergency fund. On the other hand, if you have a low-paying job or a lot of expenses, you may need to have a larger emergency fund.

It’s important to remember that your emergency fund is not an investment. It’s not meant to grow in value over time. It’s simply a safety net that you can use to cover unexpected expenses.

If you’re not sure how much money you should have in your emergency fund, start by estimating your monthly expenses. Then, multiply that number by 3 or 6 to get the total amount of money you should have in your emergency fund.

Once you have a target amount in mind, you can start saving for your emergency fund. Make automatic deposits into a savings account each month, and you’ll be on your way to building a financial cushion that will help you weather any storm.

What is an Emergency Fund?

An emergency fund is a savings account that you set aside to cover unexpected expenses. These expenses can be anything from a car repair to a medical bill, and they can happen at any time. Having an emergency fund can help you to avoid going into debt or taking on high-interest loans when you need to pay for an unexpected expense.

The amount of money that you should have in your emergency fund depends on your individual circumstances. However, a good rule of thumb is to have enough money to cover three to six months of living expenses. This will help to ensure that you are prepared for any unexpected financial emergency.

There are a few different ways that you can save for an emergency fund. You can set up a separate savings account, or you can simply add extra money to your existing savings account each month. If you are struggling to save money, you may want to consider looking for ways to cut back on your expenses.

Once you have saved up enough money for your emergency fund, it is important to keep it in a safe place where you can access it easily if you need to. A savings account or a money market account are both good options for storing your emergency fund.

It is also important to remember that your emergency fund is not for everyday expenses. It should only be used for unexpected expenses that you cannot cover with your regular income. If you use your emergency fund for everyday expenses, you will not be able to save up enough money to cover a real emergency.

Having an emergency fund is one of the most important financial steps that you can take. It can help you to protect yourself from financial hardship and give you peace of mind knowing that you are prepared for anything.

V. How to Save for an Emergency Fund

Saving for an emergency fund can be challenging, but it’s important to remember that even small amounts can add up over time. Here are a few tips to help you save for your emergency fund:

- Set a goal for how much you want to save. This will help you stay motivated and on track.

- Create a budget and track your spending. This will help you identify areas where you can cut back and free up more money to save.

- Automate your savings. Set up a system where a certain amount of money is automatically transferred from your checking account to your savings account each month. This will make it easy to save without even thinking about it.

- Look for ways to earn extra money. If you’re struggling to save on your current income, consider getting a part-time job, starting a side hustle, or selling some of your unused belongings.

Saving for an emergency fund may take some time and effort, but it’s worth it in the long run. An emergency fund can help you weather unexpected expenses and give you peace of mind knowing that you’re financially prepared for anything.

VI. Using Your Emergency Fund

An emergency fund is meant to be used for unexpected expenses, such as:

- Medical bills

- Car repairs

- Job loss

- Natural disasters

- Other unexpected expenses

If you have an emergency fund, you can use it to pay for these expenses without having to borrow money or use credit cards. This can help you avoid debt and save money in the long run.

When you use your emergency fund, it’s important to replace the money as soon as possible. This will help you keep your emergency fund topped up and ready for the next emergency.

VII. Rebuilding Your Emergency Fund

After you’ve used your emergency fund, it’s important to start rebuilding it as soon as possible. Here are a few tips:

- Set a goal for how much you want to save in your emergency fund.

- Create a budget and track your spending so you can see where you can cut back.

- Automate your savings so that a certain amount is automatically transferred from your checking account to your savings account each month.

- Look for ways to make extra money, such as getting a part-time job or starting a side hustle.

It may take some time to rebuild your emergency fund, but it’s worth it to have peace of mind knowing that you’re prepared for unexpected expenses.

Emergency Fund Mistakes to Avoid

There are a few common mistakes people make when it comes to emergency funds. Avoiding these mistakes can help you save money and be better prepared for unexpected expenses.

-

Not having an emergency fund at all.

-

Keeping your emergency fund in a checking account.

-

Using your emergency fund for non-emergency expenses.

-

Not reviewing your emergency fund regularly.

By avoiding these mistakes, you can help ensure that you have the money you need when an unexpected expense arises.

IX. Emergency Fund Myths

There are many myths about emergency funds that can prevent people from saving for one. Here are some of the most common myths, and the facts that debunk them:

-

“I don’t have enough money to save for an emergency fund.”

The truth is, you don’t need to have a lot of money to start saving for an emergency fund. Even saving a small amount each month can make a big difference in the long run.

-

“I’ll just use my credit card if I have an emergency.”

Using your credit card for emergencies can be a costly mistake. Credit card interest rates are typically much higher than the interest rates on savings accounts, so you could end up paying a lot of money in interest if you use your credit card for emergencies.

-

“I don’t need an emergency fund because I have insurance.”

While insurance can help you cover some unexpected expenses, it won’t cover everything. For example, insurance won’t cover your lost wages if you have to take time off from work due to an illness or injury.

-

“I’ll just save up for a down payment on a house instead of saving for an emergency fund.”

Saving for a down payment on a house is a great goal, but it’s important to have an emergency fund in place before you start saving for a down payment. An emergency fund can help you cover unexpected expenses that could arise while you’re saving for a down payment, such as a car repair or medical bill.

If you’re not sure whether you have enough money to save for an emergency fund, or if you’re not sure how to get started, talk to a financial advisor. They can help you create a budget and a savings plan that will help you reach your financial goals.

X. FAQ

Q: What is an emergency fund?

A: An emergency fund is a savings account that you set aside to cover unexpected expenses.

Q: Why do you need an emergency fund?

A: There are many reasons why you need an emergency fund, including:

- To cover unexpected medical expenses

- To cover job loss

- To cover car repairs

- To cover home repairs

- To cover any other unexpected expenses

Q: How much should you have in an emergency fund?

A: The amount of money you should have in an emergency fund depends on your individual circumstances. However, a good rule of thumb is to have enough money to cover 3-6 months of living expenses.