What is an annuity fund?

An annuity fund is a type of investment product that provides a regular stream of income for a specified period of time. Annuities are typically purchased by retirees or those who are nearing retirement age, as they offer a way to generate income and provide a hedge against inflation.

Annuities can be purchased from a variety of financial institutions, including banks, insurance companies, and brokerage firms. There are a number of different types of annuities available, each with its own set of features and benefits.

Some of the most common types of annuities include:

- Fixed annuities: These annuities offer a guaranteed rate of return, which can be either a fixed dollar amount or a fixed percentage of the initial investment.

- Variable annuities: These annuities offer a variable rate of return, which is based on the performance of a underlying investment portfolio.

- Indexed annuities: These annuities offer a return that is linked to a specific index, such as the S&P 500.

Annuities can be a valuable tool for retirement planning, but it is important to understand the different types of annuities available and their associated risks before making a decision.

| Topic | Answer |

|---|---|

| Annuity fund | An annuity fund is a type of investment that provides a steady stream of income for retirement. |

| Annuity investment | Annuities can be a good investment for retirement planning because they provide a guaranteed income stream. |

| Retirement planning | Annuities can be a helpful tool for retirement planning because they can help you to save for retirement and provide a steady income stream in retirement. |

| Tax-deferred savings | Annuities can offer tax-deferred savings, which can help you to grow your retirement savings. |

| Fixed income | Annuities can provide a fixed income stream, which can help you to manage your retirement expenses. |

What is an annuity fund?

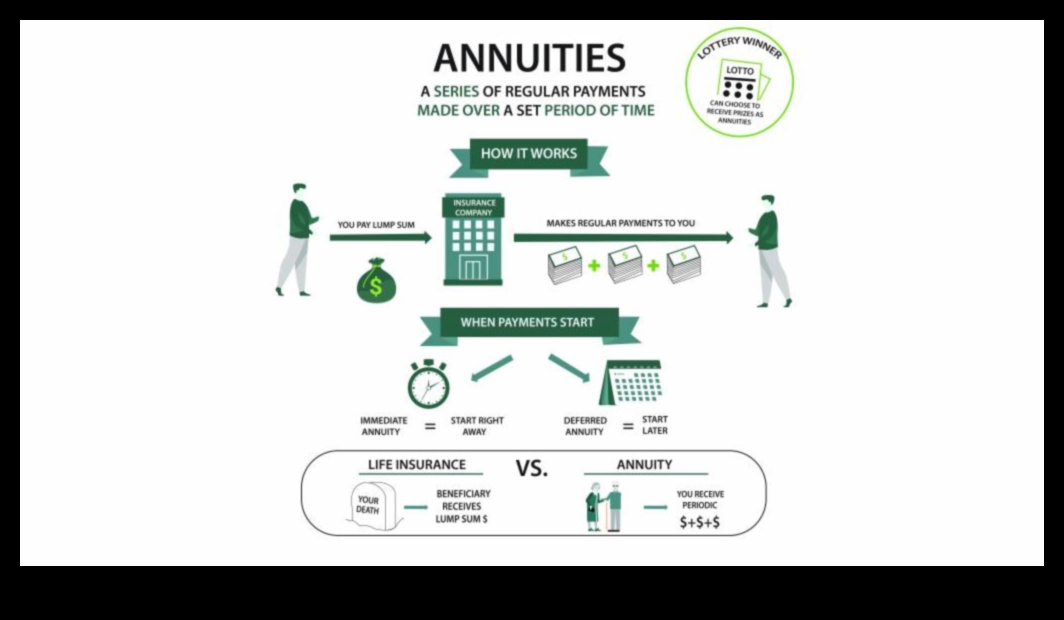

An annuity fund is a type of investment product that provides a regular income stream for retirees. Annuities are typically purchased with a lump sum of money, and the annuity company then uses that money to invest in a variety of assets, such as stocks, bonds, and mutual funds. The annuity company then uses the income generated from these investments to pay the retiree a monthly or annual income.

Annuities can be a good option for retirees who are looking for a guaranteed income stream. However, it is important to understand the different types of annuities before you make a purchase. There are two main types of annuities: fixed annuities and variable annuities.

Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns, but also the risk of losses. It is important to choose the type of annuity that is right for your individual needs and risk tolerance.

III. What are the different types of annuities?

There are two main types of annuities: fixed annuities and variable annuities.

Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry more risk.

Fixed annuities are typically purchased with a lump sum of money, while variable annuities can be purchased with either a lump sum or with regular payments.

Fixed annuities are often used for retirement savings, while variable annuities can be used for a variety of purposes, such as retirement savings, college savings, or long-term care planning.

Here is a table that summarizes the key differences between fixed and variable annuities:

| Feature | Fixed Annuity | Variable Annuity |

|---|---|---|

| Rate of return | Guaranteed | Potential for higher returns, but also more risk |

| Investment options | Limited to a few investment options | Wide range of investment options |

| Tax treatment | Tax-deferred growth | Tax-deferred growth, but taxes must be paid on earnings when withdrawn |

| Flexibility | Less flexible than variable annuities | More flexible than fixed annuities |

I. What is an annuity fund?

An annuity fund is a type of investment product that provides a regular stream of income for a set period of time. Annuities are often used as a retirement planning tool, as they can provide a guaranteed income stream in retirement.

There are two main types of annuities: fixed annuities and variable annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns, but also carry more risk.

Annuities can be purchased from insurance companies or financial institutions. When you purchase an annuity, you will typically make a lump-sum payment or a series of payments over time. The money you invest in an annuity will grow tax-deferred, and you will not be taxed on the earnings until you start to withdraw them.

Annuities can provide a number of benefits for retirees, including:

- A guaranteed income stream

- Tax-deferred growth

- Protection from inflation

- Flexibility in how you receive your payments

However, annuities also have some drawbacks, including:

- High fees

- Potential for loss of principal

- Complexity

It is important to carefully consider the pros and cons of annuities before making a decision about whether or not to purchase one.

What is an annuity fund?

An annuity fund is a type of investment product that provides a regular stream of income for a specified period of time. Annuities are typically purchased with a lump sum of money, and the annuity company then uses that money to invest in a variety of assets, such as stocks, bonds, and mutual funds. The returns on these investments are used to pay the annuity’s monthly or annual income payments.

Annuities can be a good option for retirees who are looking for a steady source of income in retirement. However, it is important to understand the different types of annuities before you make a purchase, as some annuities may be more suitable for your needs than others.

I. What is an annuity fund?

An annuity fund is a type of investment product that provides a regular income stream for the investor. Annuities are typically sold by insurance companies, and they can be used to provide retirement income, supplement other sources of income, or save for a specific goal.

Annuities work by pooling the money of multiple investors and investing it in a variety of assets, such as stocks, bonds, and cash. The returns on these investments are used to pay the investors a regular income stream.

There are two main types of annuities: fixed annuities and variable annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns, but also the risk of losses.

Annuities can be a good investment for people who are looking for a secure source of retirement income. However, it is important to understand the risks and rewards of annuities before making a decision.

VII. How much does an annuity cost?

The cost of an annuity depends on a number of factors, including the type of annuity, the term of the annuity, and the annuity’s assumed interest rate.

Fixed annuities typically have lower costs than variable annuities, and shorter-term annuities typically have lower costs than longer-term annuities. The assumed interest rate used to calculate the annuity’s payments also affects the cost of the annuity.

Annuity costs can also be affected by fees, such as mortality and expense fees. Mortality fees are charged to cover the cost of paying for death benefits, and expense fees are charged to cover the cost of administering the annuity.

It is important to compare the costs of different annuities before making a decision, as the costs can vary significantly.

IX. How do I manage my annuity?

Once you have an annuity, there are a few things you can do to manage it.

- Make sure you understand the terms of your annuity. This includes the interest rate, fees, and surrender charges.

- Make regular payments into your annuity. This will help you grow your money and reach your retirement goals.

- Review your annuity periodically. This will ensure that it is still meeting your needs and that you are on track to reach your goals.

- If you need to access your money early, there may be some fees or penalties. Be sure to understand these before you make any withdrawals.

If you have any questions about managing your annuity, be sure to contact your financial advisor.

IX. How do I manage my annuity?

Once you have purchased an annuity, there are a few things you can do to manage it.

First, you will need to decide how you want to receive your annuity payments. You can choose to receive them as a lump sum, or you can spread them out over time. If you choose to receive them over time, you will need to decide how often you want to receive them.

You will also need to decide what to do with your annuity payments. You can use them to supplement your income, pay off debt, or save for retirement.

If you need help managing your annuity, you can contact your annuity provider. They can help you make decisions about how to receive your payments and what to do with them.

Here are some additional tips for managing your annuity:

- Make sure you understand the terms of your annuity contract.

- Keep track of your annuity payments.

- Review your annuity periodically to make sure it is still meeting your needs.

- If you have any questions about your annuity, contact your annuity provider.

FAQ

Q: What is an annuity fund?

A: An annuity fund is a type of investment product that provides a guaranteed income stream for a specified period of time. Annuities are typically purchased with a lump sum of money, and the annuity company then invests the money and uses the earnings to pay the annuity payments.

Q: How do annuities work?

A: Annuities work by providing a guaranteed income stream for a specified period of time. The annuity company invests the money you deposit and uses the earnings to pay the annuity payments. The amount of your annuity payments will depend on the type of annuity you choose, the amount of money you deposit, and the annuity company’s investment performance.

Q: What are the different types of annuities?

A: There are two main types of annuities: fixed annuities and variable annuities. Fixed annuities provide a guaranteed income stream, while variable annuities offer the potential for higher returns but also carry more risk.