I. Introduction

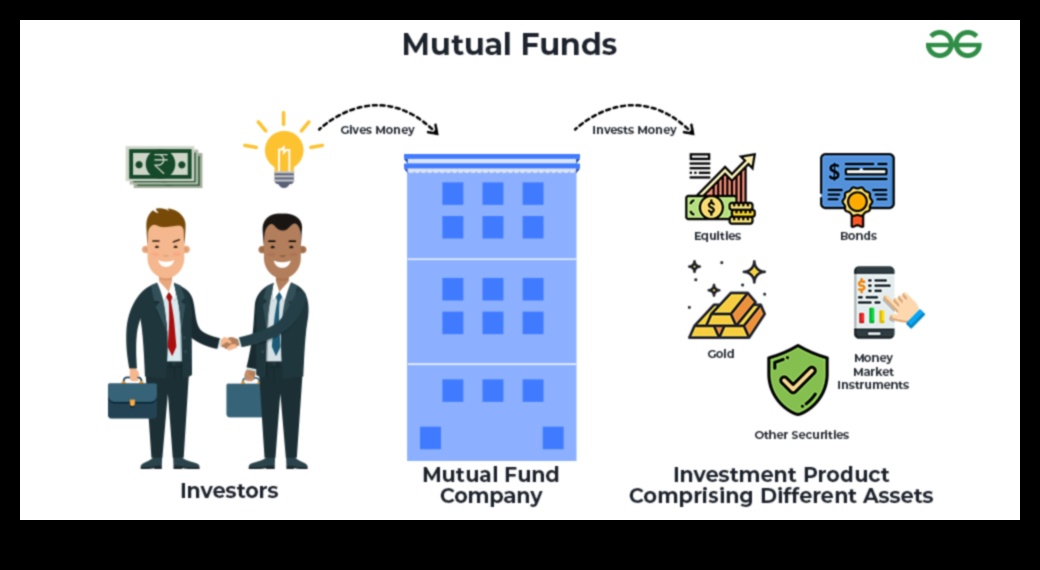

Mutual funds are a type of investment that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds can be a good investment for people who want to diversify their portfolios and who don’t have the time or expertise to manage their own investments.

II. What are mutual funds?

A mutual fund is a type of investment that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds can be a good investment for people who want to diversify their portfolios and who don’t have the time or expertise to manage their own investments.

III. How do mutual funds work?

When you invest in a mutual fund, you are essentially buying a share of the fund’s portfolio. The fund manager uses the money from investors to buy stocks, bonds, and other securities. The value of your investment will go up and down depending on the performance of the underlying investments.

IV. Types of mutual funds

There are many different types of mutual funds, each with its own investment objective. Some of the most common types of mutual funds include:

- Stock funds: invest in stocks

- Bond funds: invest in bonds

- Money market funds: invest in short-term securities

- Index funds: track the performance of a particular index

- Target-date funds: designed to reach a specific target date, such as retirement

V. Benefits of investing in mutual funds

There are many benefits to investing in mutual funds, including:

- Diversification: Mutual funds allow you to invest in a variety of stocks, bonds, and other securities, which can help to reduce your risk.

- Professional management: Mutual funds are managed by professional investment managers who have the expertise to select and manage investments.

- Convenience: Mutual funds are easy to invest in and can be purchased through a variety of financial institutions.

- Tax efficiency: Mutual funds can be tax-efficient investments, especially for long-term investors.

VI. Risks of investing in mutual funds

There are also some risks associated with investing in mutual funds, including:

- Market risk: The value of your investment can go up and down depending on the performance of the underlying investments.

- Manager risk: The performance of your mutual fund can depend on the skill of the fund manager.

- Liquidity risk: Mutual funds may not be as liquid as other investments, such as stocks or bonds.

VII. How to choose a mutual fund

When choosing a mutual fund, there are a few things you should consider, including:

- Your investment objective

- Your risk tolerance

- Your time horizon

- Your budget

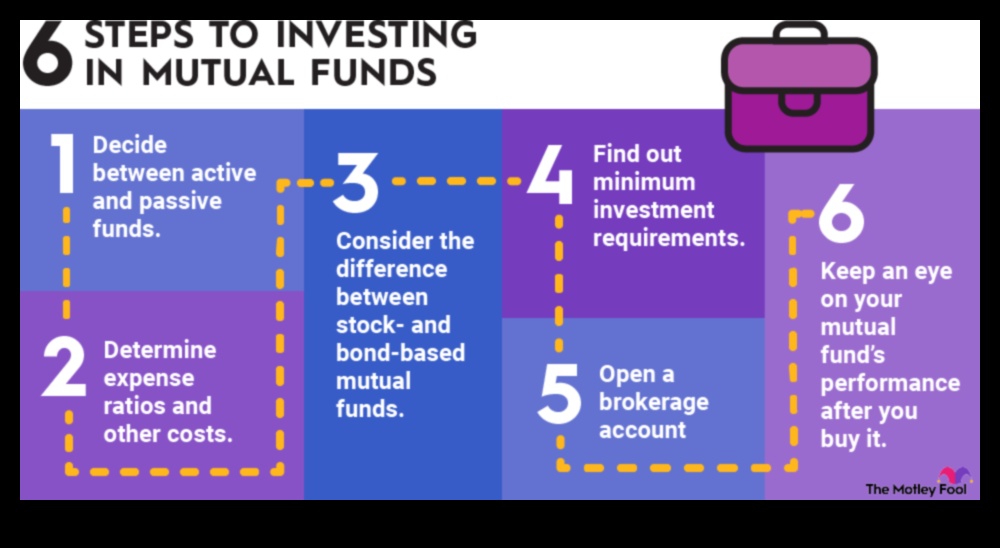

VIII. How to invest in mutual funds

You can invest in mutual funds through a variety of financial institutions, including banks, brokerage firms, and mutual fund companies. To invest in a mutual fund, you will need to open an account with the financial institution and provide some basic information, such as your name, address, and Social Security number. You will also need to make a deposit into your account.

Once you have opened an account and made a deposit, you can start investing in mutual funds. You can do this by choosing a mutual fund from the list of available funds and then making a purchase. The amount you invest will depend on your budget and investment goals.

IX. Performance of mutual funds

The performance of mutual funds can vary significantly from one fund to another. Some funds may outperform the market over time, while others may underperform. It

| Topic | Answer |

|---|---|

| Investment | Mutual funds are a type of investment that allows investors to pool their money together and invest in a diversified portfolio of stocks, bonds, and other securities. This can help investors to reduce risk and achieve their investment goals. |

| Stock market | Mutual funds can be invested in the stock market, which is a market where stocks are bought and sold. The stock market can be volatile, so mutual funds that invest in stocks can be riskier than those that invest in other types of securities. |

| Risk | The risk of investing in a mutual fund depends on the type of fund and the specific investments that the fund makes. Some mutual funds are riskier than others. |

| Return | The return on a mutual fund depends on the performance of the investments that the fund makes. Some mutual funds have higher returns than others. |

What are mutual funds?

A mutual fund is a type of investment vehicle that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are typically managed by professional investment managers who are responsible for selecting the investments that make up the fund’s portfolio.

Mutual funds offer a number of benefits to investors, including:

- Diversification: By investing in a mutual fund, you can diversify your portfolio and reduce your risk of loss.

- Professional management: Mutual funds are managed by professional investment managers who have the expertise and experience to select investments that are likely to outperform the market.

- Convenience: Mutual funds are easy to invest in and can be purchased through a variety of financial institutions.

However, mutual funds also have some drawbacks, including:

- Fees: Mutual funds typically charge fees, which can eat into your returns.

- Taxes: Mutual funds may be subject to capital gains taxes, which can reduce your overall returns.

- Liquidity: Mutual funds may not be as liquid as other investments, such as stocks or bonds.

Overall, mutual funds can be a good investment for investors who are looking for a diversified, professionally managed portfolio. However, it is important to be aware of the fees and taxes associated with mutual funds before investing.

III. How do mutual funds work?Mutual funds work by pooling money from investors and investing it in a diversified portfolio of stocks, bonds, and other securities. This diversification helps to reduce risk, and it also allows investors to access a wider range of investment opportunities than they would have if they were investing on their own.

Mutual funds are typically managed by professional investment managers who are responsible for making investment decisions on behalf of the fund’s shareholders. These managers are typically compensated based on a percentage of the fund’s assets under management.

Mutual funds can be either open-ended or closed-ended. Open-ended funds allow investors to buy and sell shares at any time, while closed-ended funds only allow investors to buy and sell shares at the fund’s net asset value (NAV).

Mutual funds are a popular investment option for investors of all experience levels. They offer a number of advantages over other investment options, including diversification, professional management, and liquidity. However, it is important to remember that mutual funds are not without risk. Investors should carefully consider their investment goals and risk tolerance before investing in a mutual fund.

IV. Types of mutual funds

There are many different types of mutual funds, each with its own unique investment objective. Some of the most common types of mutual funds include:

- Stock funds: These funds invest in stocks of individual companies.

- Bond funds: These funds invest in bonds issued by governments or corporations.

- Money market funds: These funds invest in short-term debt securities, such as Treasury bills and commercial paper.

- Index funds: These funds track the performance of a specific index, such as the S&P 500 or the Dow Jones Industrial Average.

- Target-date funds: These funds are designed to gradually become more conservative as the investor approaches retirement.

The type of mutual fund that is right for you will depend on your individual investment goals and risk tolerance.

V. Benefits of investing in mutual funds

There are many benefits to investing in mutual funds, including:

- Diversification: Mutual funds allow you to invest in a variety of stocks, bonds, and other investments, which can help to reduce your risk.

- Professional management: Mutual funds are managed by professional investment managers who have the experience and expertise to make informed investment decisions.

- Convenience: Mutual funds are easy to buy and sell, and you can do so through your brokerage account.

- Tax efficiency: Mutual funds can be tax-efficient investments, especially if you hold them in a retirement account.

Overall, mutual funds are a good investment option for investors of all experience levels. They offer a number of benefits that can help you achieve your financial goals.

VI. Risks of investing in mutual funds

There are a number of risks associated with investing in mutual funds, including:

Market risk: The value of a mutual fund can go down as well as up, and there is no guarantee that you will get back your original investment.

Investment risk: The specific investments that a mutual fund makes can lose value, which can affect the overall performance of the fund.

Management risk: The performance of a mutual fund can be affected by the skill of the fund manager.

Liquidity risk: Mutual funds may not be able to be sold immediately, and there may be a delay in receiving your money if you sell your shares.

Tax risk: Mutual funds may be subject to taxes on capital gains and dividends.

VII. How to choose a mutual fund

There are a few factors to consider when choosing a mutual fund.

- Your investment goals

- Your risk tolerance

- Your time horizon

- Your investment budget

Once you have considered these factors, you can start to narrow down your choices. You can use a mutual fund screener to compare different funds based on their investment objectives, risk level, fees, and performance.

Once you have found a few funds that you are interested in, you can read the fund prospectus to learn more about the fund’s investment strategy and performance history. You can also talk to your financial advisor to get their advice on which fund is right for you.

Here are some tips for choosing a mutual fund:

- Don’t just choose a fund based on its past performance. Past performance is not an indicator of future returns.

- Consider the fund’s fees. Mutual funds can have high fees, so it is important to compare the fees of different funds before you invest.

- Diversify your portfolio. Don’t invest all of your money in one fund. Instead, invest in a variety of funds to spread out your risk.

- Rebalance your portfolio regularly. As your goals and risk tolerance change, you may need to rebalance your portfolio to make sure that it is still aligned with your financial goals.

Choosing a mutual fund can be a daunting task, but it is important to do your research and choose a fund that is right for you. By following these tips, you can increase your chances of making a successful investment.

How to invest in mutual fundsThere are a few different ways to invest in mutual funds. You can invest directly through a mutual fund company, through a broker, or through a retirement plan such as a 401(k) or IRA.

To invest directly through a mutual fund company, you will need to open an account with the company. You can then choose the mutual funds that you want to invest in and make regular contributions.

To invest through a broker, you will need to open an account with a brokerage firm. You can then choose the mutual funds that you want to invest in and make regular contributions. Your broker will charge a fee for their services.

To invest through a retirement plan, you will need to have an employer-sponsored plan such as a 401(k) or IRA. You can then choose the mutual funds that you want to invest in and make regular contributions. Your employer may match your contributions, which can help you to grow your retirement savings.

Once you have chosen a way to invest in mutual funds, you will need to decide how much you want to invest and how often you want to make contributions. You should also consider your investment goals and risk tolerance.

If you are new to investing, it is a good idea to talk to a financial advisor before you make any decisions. A financial advisor can help you to create a personalized investment plan that meets your needs and goals.

IX. Performance of mutual fundsThe performance of mutual funds can vary significantly from one fund to another. Some funds may outperform the market over time, while others may underperform. There are a number of factors that can affect the performance of a mutual fund, including the investment strategy of the fund manager, the fees charged by the fund, and the market conditions.

In general, actively managed mutual funds tend to have higher fees than passively managed funds. This is because actively managed funds require a team of investment professionals to research and select investments, while passively managed funds simply track an index. As a result, actively managed funds may be able to outperform the market in some years, but they are also more likely to underperform the market in other years.

Passively managed funds, on the other hand, tend to have lower fees and are less likely to underperform the market. However, they are also less likely to outperform the market.

Ultimately, the best way to determine whether a mutual fund is a good investment for you is to consider your own investment goals and risk tolerance. If you are looking for a safe investment with low risk, then a passively managed fund may be a good option. However, if you are willing to take on more risk in the hopes of achieving higher returns, then an actively managed fund may be a better choice.

FAQ

Q1: What are mutual funds?

A mutual fund is a type of investment vehicle that pools money from multiple investors and invests it in a variety of stocks, bonds, and other securities. Mutual funds are often used by investors who want to diversify their portfolios and reduce risk.

Q2: How do mutual funds work?

When you invest in a mutual fund, you are essentially buying shares of the fund. The fund manager then uses this money to purchase a variety of investments, such as stocks, bonds, and other securities. The value of your shares will go up or down depending on the performance of the underlying investments.

Q3: Are mutual funds a good investment?

Mutual funds can be a good investment for investors who are looking for a diversified portfolio and who are willing to accept some risk in exchange for the potential for higher returns. However, it is important to remember that there is no guarantee that any particular mutual fund will outperform the market.